Listen to the MP3 audio file

The Solari Report – 13 May 2010

Download the MP3 audio file

The outlines of our situation are becoming clearer to a much wider audience. For many years, there has been an assumption that sovereign governments could print paper and make promises and somehow find ways of making good on all of them.

While that is still theoretically true for powerful nations, global governance is now struggling with a level of financial and physical violence that is destroying fundamental trust. The psychological impact of the 1,000 point drop in the Dow last week, ecological harm in the Gulf of Mexico and corruption surrounding the events in Greece will prove to be significant no matter how much money the Federal Reserve and the European central banks print. Expect bailout proportions to gush into the markets this week.

We have long recommended silver and gold as a form of currency that does not depend on government printing presses or military might. While governments can intervene and manipulate the price and volume in the short run, in the long run fundamental economics matter. The contraction between paper and real things is accelerating. Gold and silver are real. Paper money is increasingly real only if it is secured by real resources and an enterprise that honors contracts.

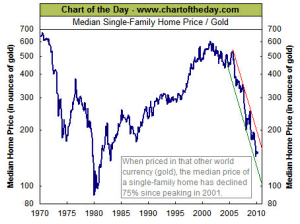

Particularly chilling was last week’s chart showing the decline in the value of American homes priced in gold. The possibility that debt might do to equity markets what it has done to housing values has investors concerned.

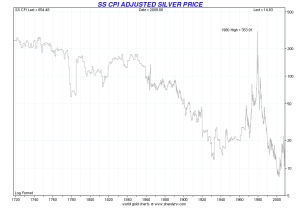

On this week’s Solari Report, in Money & Markets, Catherine will describe the signs that we have arrived at a tipping point. We will review the price of precious metals on an historical basis. Adjusted for inflation, prices are still significantly beneath historical highs.

Nick Laird’s charts at sharelynx.com show a constant dollar gold high of $2,000. His comment on the high recently was “The prices reflected are not intraday & only daily closes so the charts do not reflect the absolute high of 1980 when gold hit $860. If I was to use the Intraday high then gold would have hit $2200. And if I was to use John Williams’ ShadowStats CPI data then the 1980 high would equal $5000.” (If you have not had the opportunity to listen to John Williams’ interview on the Solari Report last week, it is highly recommended!)

Because it is critical that you are prepared, Franklin Sanders of The Moneychanger and I are going to review again the actions that you and your family should be taking in this environment. We will review your options for purchasing gold and silver to hold at home, to hold at a depository, including through an IRA, or to hold abroad. We will also address how to manage the volatility of the relationship between the US dollar and precious metals.

We will also cover the next date in our series, “The Top Ten Dates in the History of Gold & Silver.”

Our movie will be a short YouTube presentation by CW Roberts, a Florida construction contractor, with a fascinating proposal on using hay to help clean up the Gulf oil spill. We will discuss Catherine’s letter to the Governors of Louisiana, Texas, Alabama, Mississippi and Florida about how they could finance the clean up, creating thousands of jobs along the coastal areas.

If you are a subscriber to The Solari Report, please let us know how we can help you navigate events this week by posting your questions for Catherine and Franklin at the cart.

Listen live on Thursday evening by phone, listen online, or by downloading the mp3 after it is posted on Friday.

If you would like to learn more about The Solari Report and subscribe, click here. Subscribers enjoy access to our complete MP3 archive, including a special Precious Metals Market Report library.

You can enjoy the Solari Report Digest podcasts for free. Click here.

This week’s Money and Markets charts will be posted at the blog on Thursday morning.