By Michael McDonald

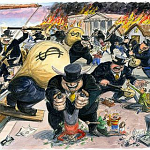

The subprime mortgage crisis isn’t the only calamity Wall Street created that’s upending the finances of U.S. states and cities.

For more than a decade, banks and insurance companies convinced governments and nonprofits that financial engineering would lower interest rates on bonds sold for public projects such as roads, bridges and schools. That failed promise has cost more than $4 billion, according to data compiled by Bloomberg, as hundreds of borrowers from the Bay Area Toll Authority in Oakland, California, to Cornell University in Ithaca, New York, quietly paid Wall Street to end agreements since 2008.