The War for Bankocracy

A Series by John Titus

Episode III out now!

The War for Bankocracy Introduction

About The War for Bankocracy

Central banks appear to be poised for a major push to replace rule by democratic governments with rule by privately owned central banks. Their chief task in this regard is to free the U.S. Federal Reserve from its constitutional constraints, which prevent the bank from operating in secrecy and beyond the reach of Congress and indeed law itself.

While the evidence supporting this conclusion is freely available from the public record, without some minimal working knowledge of central banks, the story would be extremely difficult to tell in a single video. Consequently, The War for Bankocracy series will lay significant groundwork and tell the story over the course of eight episodes.

Solari plays an important and public role in the series, serving as a depository library for both the video series and its many constituent parts. The notion here is really two-fold. First, Solari’s archival function can assist other researchers and content creators by making resource materials and video clips freely available for downloading. Second, Solari’s

website is wholly independent of the forces behind the free speech breaches that are now daily occurrences across a shocking array of platforms. Thus, Solari will serve as a safe harbor for the series, beyond the reach of the censorship complex.

What gave rise to The War for Bankocracy was a memo published by the White House shortly before President Biden’s visible mental deterioration forced him to abandon his second presidential race. The memo—which directly contradicts the U.S. Constitution by advocating governance by central banks—received no attention from the media.

STAY TUNED FOR ALL EPISODES AS THEY ARE RELEASED

Episode I

The War for Bankocracy with John Titus - Episode 1 - Warning Shot

besetting the American economic scene.

There's very likely a fairly large block of such securities out there, which we would have to pay horrendous premiums to induce the people to give up their instruments. And unless we can do that, you can't reduce the debt.

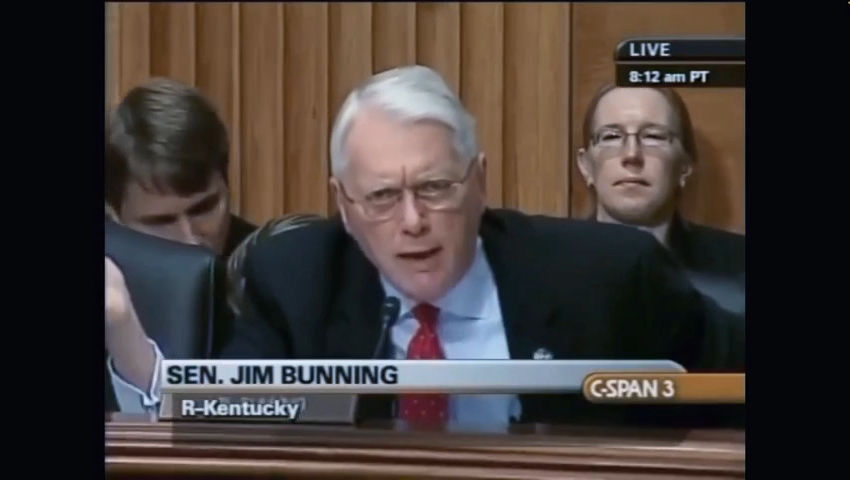

So all that information is available in our commercial paper program. And who got the money? Hundreds and hundreds of banks, any bank or that has access to the us federal Reserve's discount. Tell us who they are. No. What is the bottom line on a IG? Is it a trillion dollars? Is it $2 trillion? Where is the bottom line as far as the American taxpayer is concerned? Do you have an answer for that? I can't give you a number. Senator Bunning,

we need to know where, who benefited where this money was? There's no transparency here, and we're gonna find out the Fed can be and the treasury can be secretive for a while, but not forever.

For example, in cash we don't know, for example, who's using a $100 bill today. We don't know who is using a 1000 peso bill today. A key difference in with the C BDC is that Central Bank will have absolute control on. There are rules and regulations that will determine the use of that expression of central bank liability, and also we will have the technology to enforce that.

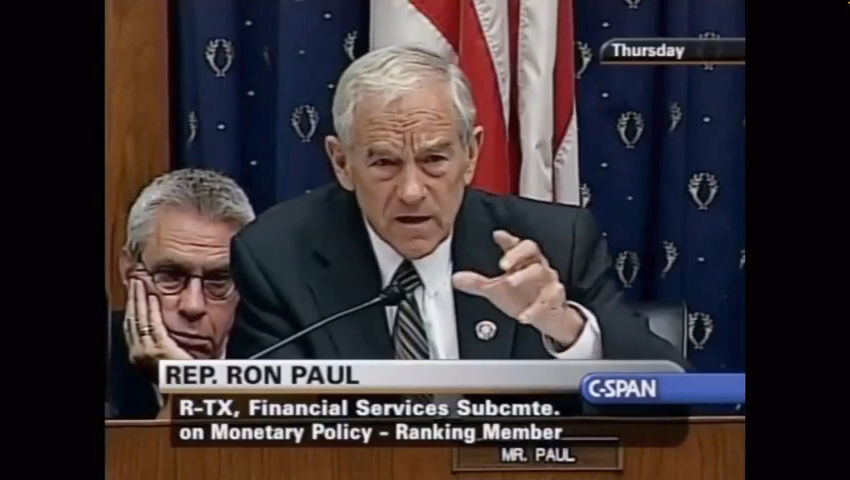

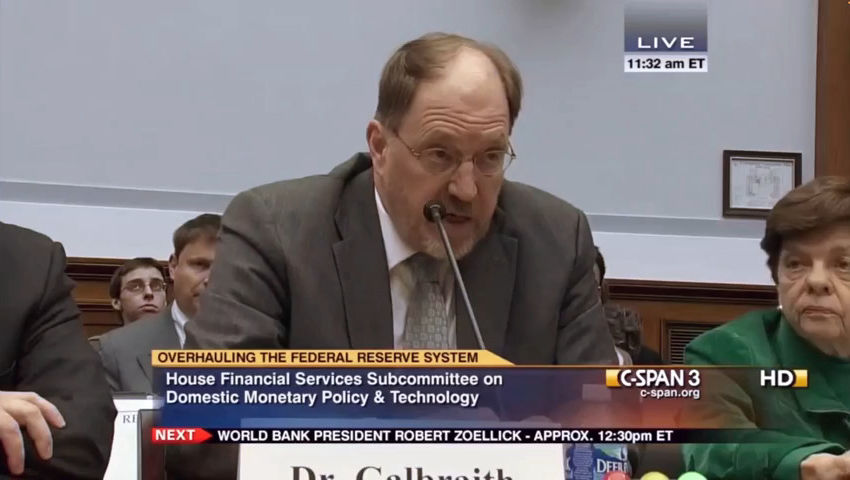

Welcome to Best Evidence, my name is John Titus. This is the first episode in an eight part series called The War for Bankocracy. I am going to make the case that modern central banks are poised to clear one last remaining hurdle before dismantling rule by democratic governments and in their place establishing central bank sovereignty and central bank dominion over nations and over people and nations, in other words rule by central bankers, certainly throughout the West and likely throughout the entire world. But to do that in a way that's remotely understandable, I need a series in order to answer A few threshold questions and a few foundational questions that are not generally known, even among educated and informed people. And that's just going to take some time and take some work. What are central banks? What do they actually do? How powerful are they now? Why are they powerful now? How do you even measure power? And if central banks are so powerful now, why haven't they taken over already? And what is so urgent that you need an entire series right now? Let me answer that last question first because it's actually the easiest one. The issue of Central Bank's legal power was actually teed up for public consumption within 24 hours of Donald Trump's election to a central term. Here is Federal Reserve Chairman Jay Powell taking questions from the press the day after Trump was elected. Let's just listen to this exchange. Some of the president's elect advisors have suggested that you should resign. If he asked you to leave, would you go? No. Can you follow up on his, do you think that legally, he, that you're not required to leave? No. Do you believe the president has the power to fire or demote you, and has the Fed determined the legality of a president demoting at will any of the other governors with leadership positions? Not permitted under the law. Not permitted under the law. So the chairman of the central bank in the United States is saying the president of the United States can't fire him. But what does Trump himself say? Here you go. The chairman of the Federal Reserve, Jerome Powell, said he will not leave his post even if you ask him to. Will you try to replace Jerome Powell? No, I don't think so. I don't see it. Okay. So you might ask since Trump and the Fed are agreeing here, why is this such an issue? And the answer is, it's what led up to these exchanges. That's such a huge problem. And what led up to these exchanges was over 300 years of central banks encroaching on the authority of nations to control and to issue their own money, encroaching, to be clear, on the sovereignty of countries. The clips you just saw are actually just reflections of the latest moved on the Global Central Banking Chess Board, which took place last year. And that was the publication of a memo. By the Biden White House in May of 2024 about central bank power. The memo is so deeply disturbing that I thought it warranted an entire series to explain the danger that it poses. I want to just read from the memo supposedly written in response to prior statements about the Fed from Donald Trump on the campaign trail. The memo could have just said what Jay Powell said that the president lacks the power to fire the Fed chairman, and that's right as a matter of law, And the White House memo could have left it at that. And if you don't understand why Jay Powell is right about that, this series, and in fact this episode in a few minutes is going to clear that up for you. But the Biden White House memo did not say what Jay Powell said. The memo had this to say instead. I'm just going to read from the memo. It says, among other things, Nearly all advanced economies in many developing countries are now governed by Independent central banks, whose governing bodies decide monetary policy without political input. Approval or fear of reprisal governed by independent central banks, not governed by elected representatives, not governed by a constitution, not by the rule of law, not by three branches of government, not governed by the people, not even governed democratically, governed by independent central banks, and nearly all advanced economies, according to the Biden White House. The scary thing about that statement, actually, is that it's pretty much true with one. Rockets, red glaring exception here in the good old U. S. of A, which the Biden memo leaves out. The U. S. is not governed by a central bank. It is thus not governed by an independent central bank, nor can it be due to the U. S. Constitution, which the Biden memo also leaves out. It likewise omits any mention of the Federal Reserve Act, and it treats the Fed like every other central bank in the world. Especially the European Central Bank, the ECB, and that is the problem. To show you how huge a problem it is, it's just going to take me a few episodes. Number one, to cut through the mystique of central banks and get to their actual power that they truly hold. And number two, to cover, like I said, over 300 years of history. That led up to this warning shot from the Biden administration, which is what that memo is, because let's face it, when it comes to central banks, Biden's advisers who wrote that memo are no different than Donald Trump's advisers, are no different than Fed bankers, or ECB, or Bank of England bankers, all central bankers are relentless, furtive power grabbers, and the end of the runway is now in sight, the runway I want to share with you what I see here, especially given the ambitious financial and monetary projects that have been bandied about in the very first days of the second Trump administration. Now, I am not going to get into the details of those projects here. There really aren't any. It's too early. The series instead is going to provide a legal and historical framework for what appears to be coming, and by the looks of it, it's going to be big. We're going to go through the record. If you've seen my videos before, you know that I use actual documents. My videos feature highlights and zooms on actual text and documents. I even use footnotes on the screen with sources linked in the video description box. But with this series, I'm taking that approach to the next level. I've actually wanted to do this for a while but I'm finally in a position now to do it. I think a series like this will probably end up being my go to format for videos, actually. But that brings up the topic. of the series schedule and the series structure. This is Episode 1, as I said. Episode 2, if things go as planned, will be out two weeks from today. Episodes 3 and 4 will follow that bi weekly schedule. Then there will be a four week intermission collect our thoughts and move forward, and then Episodes 5 through 8 will resume the bi weekly schedule. If it all goes as planned, the series will be over and done with. I think the day after Memorial Day. I may end up with a bonus episode or interviews, we'll see. But the core of the series is eight episodes. In any case, check solari. com, URL on the screen, check solari. com for the latest scheduling info. On that note, I need to explain the series I'll call it meta structure. My regular videos have a video itself. It has references in the description box. And usually I put up a sub stack post in connection with each video, but there are at least two limitations to that approach from my point of view. Number one, my videos post on YouTube, Odyssey and BitChute all under the best evidence channel. If my channel gets canceled, which I don't think will happen, I'll talk about that in a minute, but if my channels get canceled, my videos are gone. The second limitation to that approach is the description box can provide a link to a source. But it can't provide the source itself. There's just not enough space. And there's a ton of underlying materials that I want to make available to other researchers, to other creators who might see this series and want to use some of the materials. For example, you saw clips of Alan Greenspan in the title sequence. It would be nice if you could get those clips, and not just a link to the C SPAN three and a half hour video of that hearing. And that is where Catherine Austin Fitts and Solari come into play. You saw her name and the name Solari in the title sequence. This is the first video I've made, first best evidence video I've made, in association with anyone. And I'm proud to do so now with Catherine and Solari, because we are blazing a new trail as far as I know. away from the censorship machine and the censorship complex that is raging right now. And quite fittingly, it is a trail that celebrates the U. S. Constitution by showing how powerful and how crucial that document actually is right now. Catherine has generously agreed to host the series. and its constituent parts on a webpage dedicated to the series on solari. com. The address for the webpage is on the screen now, so it's baked into the video, so to speak. And as usual, I'll make extensive use of footnotes throughout the series with links in the description box. But again, that's just links. And at Solari, you get not just the links, but the underlying content too. For example, a hearing transcript or a video clip. I should point out here that hearing of Greenspan from January 25th, was it 2001? There's no transcript for that hearing. If you go to the official congressional site and try to download the hearing, there is no hearing. It's a miracle I found the C SPAN video. So if any of my viewers or subscribers point me in the right direction there I would be greatly indebted to you. But anyway, Solari is the depository library for the entire War for Bankocracy series. But there's two other parts of the series that I want to talk about quickly. The first is other content creators. As the series progresses, I want to discuss episodes and their relevance to other issues.

And for this reason, I have started to reach out and enlist the help of other creators like James Corbett and like Greg Honner, and of course, Catherine Austin Fitts herself I'm looking forward to those discussions. The point here is that a rolling list of updated interviews and where to find them will be available at Solari. And the final part of the series library is my own sub stack posts usually with an entry for each episode. And I'll do entries for, I'll do substack posts for interviews as well as time permits and maybe on other topics. You are looking at the URL for my substack right now on screen. But as with YouTube and other video platforms, I do not want to be at the mercy of substack. So an archive of my substack posts will also be available at Solari. Thank you, Catherine Austin Fitts. I don't know of any video project like the one that she and I are doing right now with the source documents included bundled with the project. If I did know about it, I would have copied it. But in a climate of, let's say, repressed content, I think that efforts along these lines are going to become more and more necessary. Certainly, in a minimum, I want an archival backup. Of this work because it's been a major undertaking. I have lived with this project essentially full time, 40 hours a week for the last three or four months, four months, September, and it has been a ton of work. So thank you to other creators for helping me with special thanks to Catherine Austin Fitz. She and I have done Money in Markets video show. I am told that it's not really a podcast. It's a show. It's a video show. We've done a show on Solari for over four years now, actually going on five years. And not one time has Catherine ever limited or even suggested that I so much as temper my remarks, which are rather freewheeling. So I trust her. And now I am very grateful to her for her help on this major project, which if it goes smoothly and goes well, is going to be just my first video series project like this. As I mentioned, I like this format a lot. Now, to be clear, a lot of content at Solari. com is paywalled, and that includes our Money and Markets show. However, all of the War for Bankocracy series is going to be freely accessible there. Freely accessible, I think you might have to have a subscription to comment on whatever pages are up for the War for Bankocracy series. But all the materials in all the constituent parts of the series are freely accessible at Solari. And in that connection, I should mention, there's a ton of materials related to this series also available for free at Solari. For example, there is a huge trove of work. called missing money relating to 21 trillion of undocumented adjustments to the federal budget over the decades. The connection to the federal reserve gang. The New York Fed is the fiscal agent of the U. S. government. Catherine Austin Fitts and Professor Mark Skidmore of Michigan State did a ton of work on that. Links to their work and that are relevant to the War for Bankocracy series can be found on the War for Bankocracy webpage. I think that takes care of housekeeping. Check Solari for serious updates and information. Catherine's got a whole team at Solari. I've worked with them over the years. And they are superb at what they do. Now, I want to turn back to the problematic Biden White House memo and get into some specific red flags, starting with its title. As you can see, the title of the memo is The Importance of Central Bank Independence. It's not the importance of Federal Reserve independence. It's the importance of Central Bank independence. And legally, That is a dead giveaway as to what's really at work here. Legally, central bank independence is night and day different from Federal Reserve independence. Central bank independence means the central bank doesn't answer to and is in no way controlled by the national government. And that's the express position of the Biden White House too, as you're going to see. Federal Reserve independence, by contrast, means that the Fed does answer to and is controlled by the national government. specifically Congress, but that the Fed doesn't answer to the President. That's what Jerome Powell said, and that's what Donald Trump agreed to. So the meaning of Federal Reserve independence is narrow. It means independent of the President. That's it. It basically means the Fed Chairman is in a cabinet position. Central Bank independence, by contrast, is broad. It means the Central Bank is independent of the entire national government, And the Central Bank is free to do whatever it wants to with money used by the people in a nation who have no control, through Parliament or otherwise, over their own money. That construct is actually legally impossible in the U. S. due to the Constitution, specifically due to Article 1, Section 8 of the Constitution, under which credit issuance and money coining are expressly identified sovereign powers belonging to Congress. Article 1, of course, establishes Congress and sets forth Congressional powers. Most of those powers, including credit, issuance, and money coining, are in Section 8, which has a laundry list of sovereign powers belonging to Congress. So even though the Fed has been delegated a lot of monetary power, that power always remains with Congress due to the Constitution. And thus the Fed can never be independent of Congress. Because Congress has constitutional duty of oversight over the power that it delegated. The Fed is like someone who rents a house. The renter has the right to possession based only on a secondary document, which is the lease from the homeowner. The primary document for the house is the deed. which only lists the homeowner, not the renter, on that document. It's the same thing with the Fed. It's right to coin money is based on secondary document, which is the Federal Reserve Act. The primary document, make no mistake about it, is the Constitution, which only lists Congress, not the Fed, next to money coining. So why does that matter? It matters because if the homeowner doesn't renew the lease, the renter is out of the house. And the same thing is true of the Fed. Congress can choose not to renew the Fed's money coining lease simply by repealing the Federal Reserve Act with a majority vote. Fed officials know this and are forever trying to cause confusion on the point by overextending the scope of Fed independence to include independence, not just from Congress, but from the President too. And that is pure legal error, as you are going to see right now. This is from a 2012 hearing. Devoted to the issue of Federal Reserve independence. In the House of Representatives, you are looking at James Galbraith, a University of Texas Economist who drafted various revisions, helped draft various revisions of the Federal Reserve back, going back to the late 1970s. We'll get to that later. For now, it suffices to say that Galbraith knows what he's talking about. Here he is replying, To testimony from another witness, Fed Vice Chairman Donald Cohn. Cohn in his testimony failed to mention any number of material points about Federal Reserve Independence that Galbraith is about to nail down in rebuttal. Cohn, by the way, is the guy in the title sequence who refused to commit to Fed. To $2 trillion bailout of a IG with freshly printed money. We'll cover that story in episode four, but right now, let's hear from Galbrath. I want to begin with a comment on this question of independence, which has been touched on repeatedly, vice chairman. Cone said, and I think with very carefully chosen words that the Congress granted a substantial degree of independence to the Federal Reserve. That independence is, of course, independence from the executive branch. It is not and cannot be independence from the Congress itself. The Federal Reserve may be delegated certain functions by the Congress, but the Congress can always choose to hold it accountable. And this committee of course has the responsibility of oversight precisely for that reason. So I think we should be very clear that when speaking of the independence of the Federal Reserve, it's a legal independence of a kind that other regulatory institutions have had over the course of our history. There's not an independence which is specific to monetary policy per se. That is the most succinct and accurate summary of Federal Reserve independence that I've ever seen. But James Galbraith is exactly right. Federal Reserve independence just means independence from the executive branch. As I mentioned earlier, the Federal Reserve chairman is not a cabinet position, so the president can't fire the Fed chairman like he can fire the Treasury Secretary or the Attorney General or other members of his cabinet. But the reason Central Bank independence in the U. S. Can't be extended to mean independent of government. Is that the Fed was created by Congress and can be dismantled by Congress just as easily. A majority of the House, a majority of the Senate, a signature of the President, and the Federal Reserve is gone. The Fed answers to Congress because it can be snuffed out by Congress tomorrow if Congress so chose. So Federal Reserve Independence and Central Bank Independence are two different, An opposite legal concept. Central bank independence means the national government can't touch the central bank, and that's simply untrue in the U. S. In fact, the Federal Reserve Act itself uses the term central bank expressly to mean foreign central bank. So not only is the term Federal Reserve independence not interchangeable with central bank independence, The term Federal Reserve is not interchangeable with Central Bank. It's a really important point. So let's take a look at the black letter of the Federal Reserve Act itself. So you can see that what I am telling you is true. Okay. You are looking at a PDF. of the Federal Reserve Act. Let's search on Central Bank in the search box above my head and see that what I'm saying is true. Let me just paste it in there from the clipboard. And you can see over here on the left panel that the term Central Bank appears seven different times on four different pages. Let's just punch through them one by one and see what we have. Let me start at the top. There we go. Okay, so this is the first instance of Central Bank appearing in the Federal Reserve Act, and you can see it shows up in Section 11C, Master Account and Services Database, and this points out that Central Bank is defined in Section 25B. So let's keep going because it's going to depend on the definition of Central Bank which we're going to get to. So the next three instances of Federal, of Central Bank in the Federal Reserve Act are here. And as you can see from the top of the page, these appear in Section 25B of the Federal Reserve Act. Let's just go through them one by one. Federal Reserve Banks receiving property of foreign states and central banks. So they're foreign there. From, for the account sec, The second one for the account of a central bank of any such foreign state. And lastly the name of such foreign state or such central bank. So these, all three of these mentions of central bank here are foreign central banks. Let's keep it going. Next instance is here. Again, it's Section 25B of the Federal Reserve Act. Same language. Such foreign state or such central bank. Foreign central bank. And finally, we come to the definition of central bank. This appears, you would think, in section 25C. but it's actually not. 25C of the Federal Reserve Act starts here. So the instances of central bank on this page come before section 25C, meaning these two instances of central bank are in 25B. You can see from the top here its definitions. Here is the express definition. The term central bank includes any foreign bank or banker authorized to perform any one or more of the functions of a central bank. Let me read that again. Central Bank. The term Central Bank includes any foreign bank or banker authorized yada, yada. Central Bank in the Federal Reserve Act means foreign central bank. You just saw that. Let me put it this way. The Federal Reserve Act expressly uses the term Federal Reserve Bank 165 times. to describe the central bank of the United States and use the term central bank seven times when talking about foreign central banks. Conversely, the Federal Reserve Act uses the term Federal Reserve Bank zero times to describe a foreign central bank and uses the term central bank zero times to describe a Federal Reserve Bank, a regional Federal Reserve Bank here in the U. S. There is no legal overlap between Federal Reserve Bank, a U. S. institution, and Central Bank, a foreign institution. The term Federal Reserve Bank and Central Bank are mutually exclusive terms. The title of the White House memo should be the importance of Federal Reserve independence, but it is not the title because the White House is pushing a globalist, Anti constitutional, anti sovereign nation agenda here. Now, this memo was not written on a lark. There are material changes to the World Reserve currency, and thus to the global monetary system, underway right now. Do not kid yourself about that. It's going on as we speak. Now, you might think I'm not in the U. S., this doesn't pertain to me. If so, you were very much mistaken about that. The Federal Reserve in the U. S. is unique among central banks, not just because the U. S. dollar is the world reserve currency, and not just because U. S. dollar denominated assets account for something like 60 percent of the global total, but because of the U. S. Constitution. The Constitution is what's keeping the window of transparency into the Fed open. permanently open. And by extension, it keeps open a degree of transparency into foreign central banks as well. True, the Federal Reserve is not completely transparent, but legally, Congress, meaning directly a representative, directly elected representatives of the U. S. people have the right to access any information they want from the Fed whenever they want it, and if you don't think that's the case, it really is testament to the Fed's success in pushing total lies on the public. We are going to look at Galbraith again here. Here he's being questioned by Ron Paul, as you can see. The topic is foreign agreements and foreign payouts of money. But the issue is what information Congress can get from the Fed. Listen to what Galbraith says here. Maybe you could comment on these foreign agreements. These are like treaties. The Federal Reserve goes and makes these agreements and they pass out money. Does this strike you as maybe that too might be challenging if you happen to come at this from a constitutional viewpoint? I think under the Constitution the Congress has every right for whatever information it seeks from the Federal Reserve. Congress has every right to whatever information it seeks from the Fed, but no ambiguity there. So while the Fed might use its delegated money coining power to hand out money to dubious recipients, what the Fed can't do is evade scrutiny of the authority that did the delegating to begin with, and that authority legally is Congress. The Constitution requires that. It requires that the Fed answer to Congress at all times and to be transparent. To return to our owner versus renter construct Congress is the owner of the money coining house. Most certainly has the right to inspect that house regardless of what the Fed, who is merely rents the house, tells you. Congress might have to give advance notice of inspection, but Congress most certainly and most definitely has the permanent right to inspect its house. And frankly, I doubt any advance notice is required. But at any event, if Congress can pass an act tomorrow erasing the Fed from the face of the earth, and take possession of the Money House, which it can do, it can inspect that house as well. There are 900 members of the federal judiciary, and there's not one who'd make Congress actually go through the extreme hoop of dismantling the Fed just to get documents. The judges would simply order the Fed to turn the documents over, and the Federal Reserve damn well knows it. Permanent enforceable transparency is a feature of the Federal Reserve That separates it from central banks generally and from the European Central Bank in particular. The ECB has what I call window display transparency. Yeah, the ECB might issue a report here and there. And it might even be required to issue reports, but it's the ECB that has total discretion over what source documents to put into the report and whether it releases those documents. It's not going to release them. In fact, ECB officials are expressly prohibited by treaty, by law in Europe, from taking instructions from national governments. We'll see that in a later episode. Whereas the Fed has a legal duty to follow instructions from Congress, including instructions to disclose. Information that it does not want to disclose, and make no mistake about it, the yoke of enforceable transparency around the Fed's neck has a very real tendency to beef up the window display as a transparency from central banks globally, like the ECB, those central banks have to at least pretend to care about transparency, or they suffer by comparison with the Fed's disclosures, and to be blunt, quite a lot of those disclosures are forced by the very real teeth of transparency laws in the U. S. So the U. S. law is very clear. So why is it then that we see Ben Bernanke and Donald Kahn and the Fed gang consistently acting like European central bankers and refusing congressional requests for transparency and accountability? That's actually a very fundamental question, and I'm going to answer it in the next episode. But right now I'm going to answer a much easier question, which is this, how does the Fed even purport to resist congressional efforts for transparency and accountability since the law, since US law at least, is so clear cut on the side of transparency? The answer takes us back to the White House memo and to its title, Central Bank Independence, the importance of central bank independence. Central Bank Independence is one of the biggest global propaganda campaigns ever. replicated here in the US. It is aimed at convincing Congress and really the American public that the best course of action for the US is to treat the Fed just like the European Central Bank. Leave us alone, let us do whatever we want. The basic pitch of the central bank independence campaign is research shows that central banks that are independent achieve better economic results. So if you enjoy the better economic results here in the US, You best leave us, the Fed, alone, and let us function like central banks, like independent central banks, all those other independent central banks around the world. Don't ask so many questions, and don't demand disclosure of so many documents. Now, the legal case that the Fed is not independent is airtight, because the Fed absolutely cannot escape the clutches of the Fed. Of the primary bedrock legal document in the U. S., which is the Constitution, and I'm going to tell you right now, the Fed's pitch for independence, it's pitch for Congress to abandon its constitutional oversight function and just let the Fed do whatever it wants, buy assets from whomever it wants, is extremely weak. The Fed, the research the Fed is relying on is at best ambiguous, and in one very notable instance. actually undercuts the Fed's position, as you are going to see in the next episode. Separately, moreover, I am going to prove beyond any doubt at all, that a passive, hands off, don't ask any questions approach to the Fed, by Congress, is a recipe for disaster. And that's all quite aside from the untrammeled cronyism that approach begs for. So you might think that the Fed's independence pitch, its ad campaign, hasn't been effective. You would be very much wrong about that, though. Its independence pitch has been highly effective in Congress, as the following clip makes clear. One of the points that I've been trying to make, and that is transparency of the Federal Reserve. It sounded to me like the majority here is for independence, which is a code word for secrecy and in opposition to transparency. Perfectly put. Independence is a code for secrecy, a code word for secrecy. But notice that Ron Paul reveals that he's in a minority when it comes to Fed independence. And he's here complaining about the majority going along with the Fed's claim that secrecy is the best policy. And by the way, Lest ye think that Fed transparency is somehow a partisan issue, as some people would have you believe, let me show you another clip from one of the leading Democrats at that time, who was just like Ron Paul, very pro transparency, and that is Barney Frank. You're actually not looking at Barney Frank, you're looking at Ron Paul. Barney Frank, in the clip we're about to look at, is actually a witness, because the hearing is about Fed independence, and Barney Frank had chaired the House Financial Services Committee, throughout the global financial crisis. So he knew a ton about the Fed's tricks to remain secret. Listen to what he has to say. Now Mr. Frank is recognized. Thank you, Mr. Chairman. I appreciate your acknowledgement of the work we did together. And actually his work, as that began with one of your Texas colleagues, Mr. Gonzalez, who looks down at us, who was a pioneer in forcing the Federal Reserve to be open. He made them release information that they claimed didn't exist. A kind of a magical feat. But one of the things that ought to be noted, in every instance, beginning with Mr. Gonzalez, and maybe before I was here, and the work we did, as the information flow has increased, it has been beneficial. There have been none of the negative effects some people have worried about. Okay, that's a very gentle poke by Barney Frank at the Fed's Chicken Little Act when it comes to disclosing information. In other words, During the financial crisis, the Fed was forever claiming, Oh, we can't disclose information or the sky is going to fall. And Frank is there saying not only is that chicken little story bogus, but that more transparency and more disclosure are beneficial. Secrecy, as we are going to discover later in a future episode, has everything to do with protecting the Fed's power and nothing to do with helping the country. I'm flagging it for you now, though, because it's what the Fed's independence campaign is really all about. It has nothing to do. With better economic results. That's simply ludicrous as you're going to see, but in any case you might be wondering since I brought up the topic What connection there is between secrecy on the one hand and Fed power on the other or why the Fed? If it's a government agency and it's not on the profit model would be motivated to increase its power in the first place or even how to measure the power that the Fed does possess as a renter of the U. S. money coining house. Those are all good questions and their answers are inside of a Pandora's box. That we are going to be opening next episode, which you will not want to miss. In the meantime, thank you so much for watching. I will see you in two weeks. If you would like to support this channel and the War for Bankocracy series, you can do so by sending cash or check to me at the address on the screen. John Titus, 9660 Falls of the Noose Road, N. E. U. S. E. Suite 138, Box 241, Raleigh, North Carolina, 27615. I always declined a monetization option on various platforms. I do not want to give YouTube the chance, anybody the chance, to pull the rug out from under me, pull the rug out from under the channel. So director donations. are the only way I get any return on my efforts. But you or your part, you shouldn't see any ads on my channel. So if you are so inclined to help, it would be greatly appreciated. The money would go right back into the channel. I'm always looking for ways to step up content production and those methods and those means most certainly cost money. Anyhow, thank you so much for your time and attention, and I'll see you in a couple of weeks.

In May of 2024, the Biden White House published a memo declaring that the United States observes “central bank independence” and that “nearly all advanced economies are now governed by independent central banks.”

The memo—entitled “The Importance of Central Bank Independence”—expressly advocates central bank supremacy over the nation rather than three branches of government under the U.S. Constitution, which the memo never mentions.

The memo likewise avoids the term “Federal Reserve independence,” which unlike “central bank independence” actually passes constitutional muster because it recognizes the Fed as a mere creature of Congress, not as its equal or even superior.

“Federal Reserve independence” means only that the Fed is independent of the president; it doesn’t (and can’t) mean that the Fed is independent of Congress, which is the source of all of the Fed’s legal powers. The Fed is always subject to the control and inspection of Congress, which has the duty to oversee its exclusive constitutional remit of coining money.

“Central bank independence,” according to the Biden memo, means that a central bank does not answer to or even take input from the nation whose currency the bank issues. Countries with central bank independence, like those in the European Union, have no real, enforceable transparency into or control over their central banks.

The Biden White House memo advocates central bank supremacy and rejects U.S. sovereignty. If the memo’s policies were implemented, the Federal Reserve would no longer be subject to the U.S. Constitution, and thus the Fed would be able to operate—like central banks around the world—with as much secrecy as it desires. The global monetary system will go dark if this occurs.

Clips list – in order of appearance :

- CBWF dominici permanent surplus.mp4

- CBWF greenspan cant reduce debt.mp4

- sanders-bernanke who got money + new law (mar 03 2009)(davcc).mp4

- Bunn-2 davcc.mp4

- SHEL-1.mp4

- Carstens Insane 422.mp4

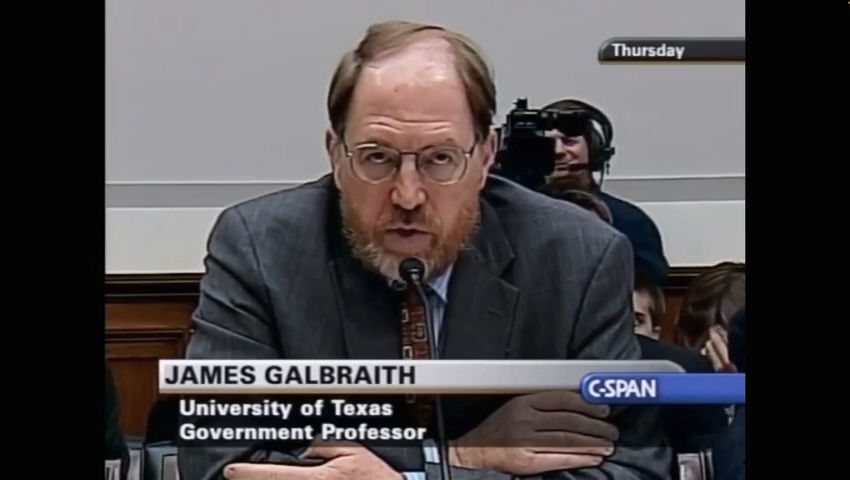

- Galbraith july 09 p28 independence from exec only.mp4

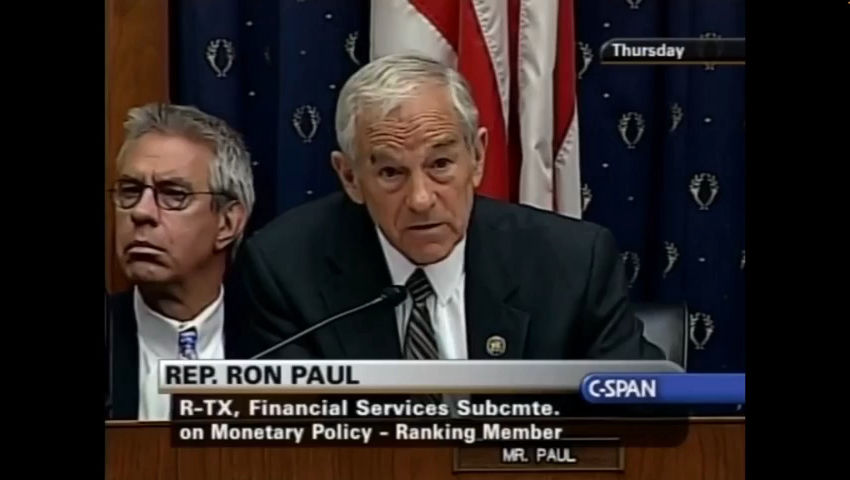

- Paul – Galbraith cong 411 A.mp4

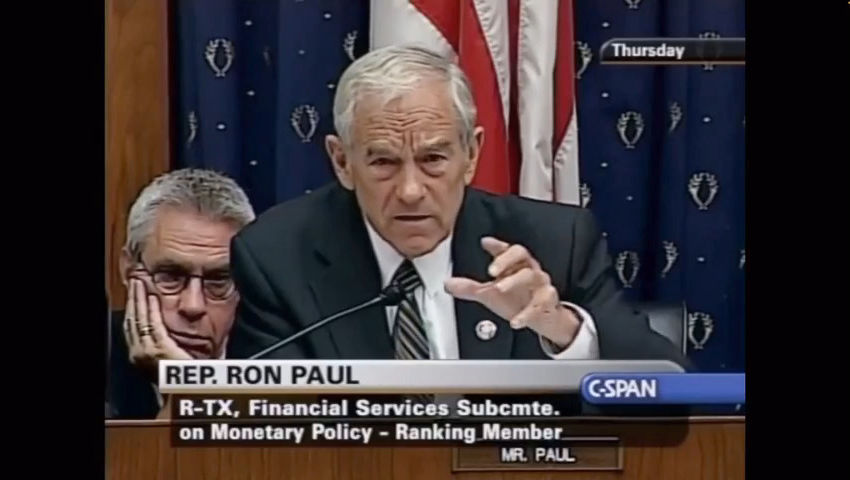

- Paul independence = secrecy

Sources:

- An Examination of What Went Wrong with American International Group, Where Government Intervention Is Headed, and the Implications for Future Regulation

- March 3, 2009 – Economic and Budget Challenges for the Short and Long Term

- Federal Reserve Act

- May 22, 2024 – The Importance of Central Bank Independence

- October 19, 2020 – Cross-Border Payments—A Vision for the Future

- The Constitution of the United States

(01) “Fed Chair Powell says he won’t resign, even if Trump asks him to,” Nov. 7, 2024, https://www.youtube.com/watch?v=umXN8ELS98s (Bloomberg TV)

(02) “Donald Trump says he won’t try to remove Fed chief Jerome Powell,” Dec. 8, 2024 (NBC News) [not shown in on-screen f.n.: https://www.nbcnews.com/politics/donald-trump/donald-trump-says-wont-fire-fed-chief-jerome-powell-rcna183276]

(03) “The Importance of Central Bank Independence,” May 22, 2024, White House Council of Economic Advisers [not shown in on-screen f.n.: https://web.archive.org/web/20250116070859/https://www.whitehouse.gov/cea/written-materials/2024/05/22/the-importance-of-central-bank-independence/]

(04) https://solari.com/the-war-for-bankocracy

(05) Hearing Before the Comm. on the Budget, U.S. Senate, 107th Cong. (Jan. 25, 2001), https://www.c-span.org/video/?162141-1/fiscal-policy

(06) https://www.govinfo.gov/app/collection/chrg

(07) https://bestevidence.substack.com/

(08) Regulatory Restructuring: Balancing the Indep. of the Fed. Reserve Sys. in Monetary Policy With Systemic Risk Reg., Hearing Before Subcomm. on Domestic Monetary Policy and Tech. of the Comm. on Fin. Servs., U.S. House of Representatives, 112th Cong. (July 9, 2009)

[not shown in on-screen f.n.:

• https://www.govinfo.gov/content/pkg/CHRG-111hhrg53234/pdf/CHRG-111hhrg53234.pdf

• https://www.c-span.org/video/?287563-1/independence-federal-reserve ]

(09) https://www.govinfo.gov/content/pkg/COMPS-270/pdf/COMPS-270.pdf

(10) See footnote (08) above.

(11) Improving the Fed. Reserve Sys.: Examining Legislation to Reform the Fed and Other Alternatives, Hearing Before the Subcomm. on Domestic Monetary Policy and Tech. of the Comm. on Fin. Servs., U.S. House of Representatives, 112th Cong. (May 8, 2012)

[not shown in on-screen f.n.:

• https://www.govinfo.gov/content/pkg/CHRG-112hhrg75727/pdf/CHRG-112hhrg75727.pdf

• https://www.c-span.org/video/?305885-2/federal-reserve-reform-economists-panel ]

(12) John Titus

9660 Falls of Neuse Rd

Suite 138, No. 241

Raleigh, NC 27615

Also Referenced:

Here you’ll find the original clips referenced in this episode.

Interview 1929 – John Titus Explains the War for Bankocracy

Interview 1929 – John Titus Explains the War for Bankocracy (audio only)

Sen. Pete Domenici – Where Is the Surplus Coming From. Are the American Tax Payers Paying More than They Should?

Hearing Before the Comm. on the Budget, U.S. Senate, 107th Cong. (Jan. 25, 2001

Sen. Bernie Sanders – Which Banks Got the Money

Sen. Jim Bunning – Where Is the Bottom Line for the American Tax Payer

Sen. Richard Shelby – It’s Disturbing That There Is No Transparency Given by the Federal Reserve

Cross Border Payment A Vision for the Future - Agustin Carstens

"Fed Chair Powell says he won't resign, even if Trump asks him to," Nov. 7, 2024

"Donald Trump says he won't try to remove Fed chief Jerome Powell," Dec. 8, 2024

Rep. Ron Paul Questioning James Galbraith on Federal Central Bank Independence from Congress and Executive Branch

Rep. Ron Paul – Federal Reserve Bank Creates Treaties Bypassing Congress

Rep. Ron Paul - Federal Reserve Bank is Government unto Itself

Click To Download PDF’s

- An Examination of What Went Wrong with American Inter- national Group, Where Government Intervention Is Headed, and the Implications for Future Regulation

- March 3, 2009 – Economic and Budget Challenges for the Short and Long Term

- Federal Reserve Act

- May 22, 2024 – The Importance of Central Bank Independence

- October 19, 2020 – Cross-Border Payments—A Vision for the Future

- The Constitution of the United States

Please send to –

John Titus

9660 Falls of Neuse Rd

Suite 138, No. 241

Raleigh, NC 27615

EXTRAS

BONUS MATERIAL

Interview 1929 – John Titus Explains the War for Bankocracy

John Titus Explains the War for Bankocracy ~

The Corbett Report on February 11th, 2025

Episode II

The War for Bankocracy - Episode II - A Government Unto Itself

The first episode in the series, “Warning Shot,” demonstrated that the most controversial statement in The Biden White House memo–namely, that nearly all advanced economies “are governed by independent central banks”–is wrong as a matter of law due to the U.S. Constitution. Because sovereign powers in the U.S. are delegated across three branches of government, the Federal Reserve doesn’t “govern” anything in the U.S. beyond what powers Congress delegated the Fed in the Federal Reserve Act.

On that score: the Fed controls every dollar it issues as Federal Reserve notes–cash–and it exerts enormous control over all $17.5 trillion in bank deposits. And all of that is quite aside from the control that the Fed exercises over retail banks as their top regulator. For all intents and purposes, the Fed controls the U.S. money supply.

The question of the Fed’s power thus becomes, where does monetary control and the power of money issuance rank among other sovereign powers like raising standing armies and issuing laws?

The answer, at least since 1694, is #1. Specifically, the power to coin money has been the apex sovereign power in nations since 1694, when the creation of the Bank of England introduced private money issuance at the sovereign level to the world. It was this development that caused money-coining to surpass the raising of standing armies as the apex sovereign power.

Before 1694, as Niccolo Machiavelli had it, “men and steel could find money and bread,” but not vice versa. In other words, so long as soldiers could find monied men, soldiers were top dog. That founding of the Bank of England in 1694 changed that dynamic forever, however. Affirming the tectonic power shift that took place after 1694, Thomas Jefferson wrote that “banking establishments are more dangerous than standing armies.”

Episode 2 traces that massive power shift to two crucial features of the Bank of England when it was founded in 1694–features that took Machiavelli’s reasoning off the table: first was the Bank of England’s private and anonymous ownership, second its issuance of debt-based money.

Importantly, the episode points out, the Federal Reserve replicates both of those features.

Thankfully, however, there are limits on the Fed’s power in the U.S. The Constitution, written in 1787 following a long war with England largely over the right to coin money, put the money-coining power in the hands of directly elected representatives, i.e., in congress. Thus even today, the Fed’s claim to “independent” status is not any stronger than a renter in possession of a home posing as its owner, as pointed out in the last episode.

There is thus enormous tension within the U.S. power structure: as a factual matter, the apex sovereign power of money-coining rests in the hands of privately owned banks; but that power is only rented.

In the U.S., the Fed–undeniably powerful though it is–cannot achieve sovereign status due to the Constitution. The European Central Bank, by way of contrast, is the legal owner of its apex sovereign power and thus is the ranking sovereign power in Europe.

Nevertheless, despite its legally subordinate status, the Fed acts “as a government to itself” by repeatedly thumbing its nose at congress, its creator. The question is how far the Fed is willing to go in order to extend its power–legally or otherwise?

A good answer can be found by closely scrutinizing the Fed’s argument for independence based on the facts, which is actually not an argument at all but something else entirely–and is the subject of the next episode.

Clips list – in order of appearance :

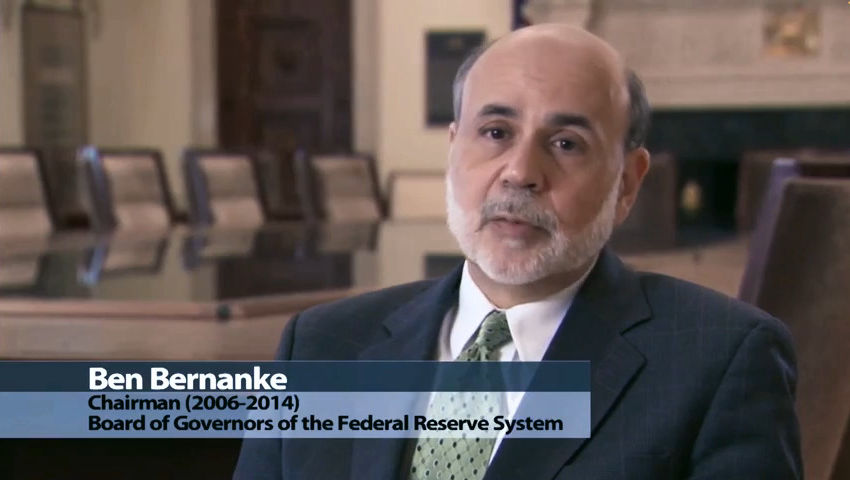

- The Federal Reserve’s Dual Mandate – Ben Bernanke

- Galbraith Fed Creature Cong May 08 2012 davcc

- Paul – Galbraith Fed govt unto itself

- sanders-bernanke intro legislation

Sources:

- March 3, 2009 – Economic and Budget Challenges for the Short and Long Term

- Thomas Jefferson to John Taylor, May 28, 1816

- May 8, 2012 – Improving the Federal Reserve System: Examining Legislation to Reform the Fed and Other Alternatives

- Machiavelli’s the Art of War by Dr. Kanchan Mishra

- July 9, 2009 – Regulatory Restructuring: Balancing the Independence of the Federal Reserve in Monetary Policy with Systemic Risk Regulation

- May 22, 2024 – The Importance of Central Bank Independence

- Federal Reserve Act

(13) “The Importance of Central Bank Independence,” May 22, 2024, White House Council of Economic Advisers

(14) https://solari.com/the-war-for-bankocracy

(15) Econ. and Budget Challenges for the Short and Long Term, Hearing Before the Comm. on the Budget, U.S. Senate, 111th Cong. (Mar. 3, 2009)

(16) Federal Reserve Balance Sheet: Factors Affecting Reserve Balances – H.4.1, Sept. 26, 2024, https://www.federalreserve.gov/releases/h41/20240926/

(17) FDIC Statistics at a Glance – Latest Industry Trends, Sept. 30, 2024

https://www.fdic.gov/quarterly-banking-profile/latest-industry-trends-september-2024-pdf

(18) “Mommy, Where Does Money Come From?,” by John Titus, Apr. 16, 2019; see https://www.youtube.com/watch?v=S_dBKAWHHQI

(19) Assets and Liabilities of Commercial Banks in the United States – H.8, Oct. 25, 2024, https://www.federalreserve.gov/releases/h8/20241025/

(20) “Fed Admits Crony Truth About Pandemic QE: ‘it creates new bank deposits’,” by John Titus, Sept. 5, 2022; see https://www.youtube.com/watch?v=n1xgQeCiu6k

(21) “Deep Diving the Fed’s Killer Whale Crisis,” by John Titus, June 6, 2023; see https://www.youtube.com/watch?v=1sCq9FJQQNA

(22) Niccolo Machiavelli, The Art of War (1520).

(23) The Works of Thomas Jefferson, vol. 11 (Paul Leicester Ford, ed., 1905).

(24) Stephen Zarlenga, The Lost Science of Money (2002).

(25) Alexander Del Mar, The History of Money in America, From the Earliest Times to the Establishment of the Constitution (1899).

(26) Alexander Del Mar, History of Monetary Systems (1895).

(27) Federal Reserve Balance Sheet: Factors Affecting Reserve Balances – H.4.1, Jan. 30, 2025; https://www.federalreserve.gov/releases/h41/20250130/h41.pdf

(28) Citigroup Inc. 2024 Notice of Annual Meeting and Proxy Statement Apr. 30, 2024; https://www.citigroup.com/rcs/citigpa/storage/public/Citi-2024-proxy-statement.pdf

(29) BlackRock 2023 Proxy Statement, May 24, 2023; https://s24.q4cdn.com/856567660/files/doc_financials/2023/ar/blackrock-2023-proxy-statement_vf.pdf

(30) Improving the Fed. Reserve Sys: Examining Legislation to Reform the Fed and Other Alternatives, Hearing Before the Subcomm. on Domestic Monetary Policy and Tech. of the Comm. on Fin. Servs., U.S. House of Representatives, 112th Cong. (May 8, 2012)

(31) European Central Bank, Statute of the ECSB and of the ECB, Institutional Provisions, Protocol as annexed to the Treaty on the European Union (2010/C 83/01); https://www.ecb.europa.eu/pub/pdf/other/ecbinstitutionalprovisions2011en.pdf

(32) Regulatory Restructuring: Balancing the Indep. of the Fed. Reserve Sys. in Monetary Policy With Systemic Risk Reg., Hearing Before Subcomm. on Domestic Monetary Policy and Tech. of the Comm. on Fin. Servs., U.S. House of Representatives, 112th Cong. (July 9, 2009)

(33) John Titus

9660 Falls of Neuse Rd

Suite 138, No. 241

Raleigh, NC 27615

Also Referenced:

Here you’ll find the original clips referenced in this episode.

The War for Bankocracy - Episode II - A Government Unto Itself

Senator Bernie Sanders - Hearing Before the Comm. on the Budget, U.S. Senate, 111th Cong. (Mar. 3, 2009)

Representative Ron Paul - Federal Hearing Before Subcommity on Domestic Monetary Policy and Tech (July 9, 2009)

James Galbraith - Hearing Before the Subcommity, On Domestic Monetary Policy and Tech (May 8, 2012)

The Federal Reserve's Dual Mandate - Ben Bernanke

Click To Download PDF’s

- March 3, 2009 – Economic and Budget Challenges for the Short and Long Term

- Thomas Jefferson to John Taylor, May 28, 1816

- May 8, 2012 – Improving the Federal Reserve System: Examining Legislation to Reform the Fed and Other Alternatives

- Machiavelli’s the Art of War by Dr. Kanchan Mishra

- July 9, 2009 – Regulatory Restructuring: Balancing the Independence of the Federal Reserve in Monetary Policy with Systemic Risk Regulation

- May 22, 2024 – The Importance of Central Bank Independence

- Federal Reserve Act

Please send to –

John Titus

9660 Falls of Neuse Rd

Suite 138, No. 241

Raleigh, NC 27615

EXTRAS

BONUS MATERIAL

Interview 1929 – John Titus Explains the War for Bankocracy

John Titus Explains the War for Bankocracy ~

The Corbett Report on February 11th, 2025

Episode III

The War for Bankocracy - Episode III - The Fed Independence Lie

More than anything else, the private owners of the Fed covet the ECB’s legal status–independence from the legislature. Because that outcome is prohibited by the U.S. constitution, however, the Fed long ago devised a sales pitch designed to get from legislators what it can’t get from the law.

The sales pitch, known as Federal Reserve Independence, promises great economic outcomes if only congress would allow the Fed to do as it pleases, free from oversight and unconstrained by any congressional checks and balances mandated by the constitution.

The White House memo is the latest version of that same pitch. Incredibly, as the White House version of the pitch has it, allowing the Fed to make large asset purchases from whomever it wants and in whatever amounts, without constraint, is the best way to control inflation.

Aside from the lack of any evidence for the White House’s position, what makes its claim so incredible is its timing, coming, as it does, immediately after (1) inflation hit a 40-year high and (2) the Fed’s balance sheet hit an all-time high as the Fed, free of congressional restraint (exactly what it had pitched for), went on its biggest asset-purchasing spree ever.

Three official sources expose the White House’s inflation claim as a bald-faced lie, starting with economists cited by the White House itself to support its position that “independent” central banks are crucial for controlling inflation. Far from supporting the White House, those economists expressly hold that independent central banks “prompted rapid increases in the price levels in many countries.”

Likewise is the former Governor of the Bank of England, Mervyn King, who publicly stated in May 2022 that the U.S. “money supply held by businesses and households was growing at 25% per year” during the pandemic due to the Fed’s asset purchases, and that that’s what caused recent bout of inflation.

Finally is the current Chairman of the Federal Reserve, who testified in June 2022 that the best way to counter recent inflation was to shrink the balance sheet that the Fed bloated beyond recognition while congress slept at the switch–exactly what the Fed’s “independence” campaign preached as the best way for controlling inflation. Turns out Fed “independence” caused an inflationary disaster that now requires the Fed to reverse course.

Indeed the most withering indictment of the Federal Reserve Independence campaign–as well as the strongest endorsement of the U.S. constitution–lies in contrasting the way congress manhandled the Fed during the global financial crisis (GFC) with its abject servility towards the Fed during the pandemic. The results are night-and-day different.

During the GFC, congress–spurred on an angry populace–pressured the Fed relentlessly, complaining about the increasing size of the Fed’s balance sheet and demanding to know the names of the institutions that were selling assets to the Fed. In other words, congress discharged its constitutional duty to rein the Fed in. Despite the major increase in the Fed’s balance sheet, no inflation followed.

During the pandemic, by contrast, congress–cowering in fear instilled by the 24/7 Covid narrative–abandoned its constitutional duty and gave the Fed exactly what its “Independence” campaign asked for–unfettered freedom to undertake “operational activities” and buy assets. Consequently, the Fed went on a $5 trillion asset purchasing spree that showed up directly in bank deposit accounts and caused the worst inflation since the 1970s.

Sources:

- Central Bank Independence and Macroeconomic Performance: Some Comparative Evidence

- Federal Reserve Act

- May 8, 2012 – Improving the Federal Reserve System: Examining Legislation to Reform the Fed and Other Alternatives

- May 19, 2023 – Central Bank Independence and Inflation Volatility in Developing Countries

- November 17, 2016 – Hearing Before the Joint Economic Committee Congress of the United States

- Monetary Policy Frameworks: An Index and New Evidence

- June 16, 2020 – The Semiannual Monetary Policy Report to Congress

- A New Measure of Central Bank Independence

- June 22, 2022 – The Semiannual Monetary Policy Report to the Congress

- May 22, 2024 – The Importance of Central Bank Independence

- July 9, 2009 – Regulatory Restructuring: Balancing the Independence of the Federal Reserve in Monetary Policy with Systemic Risk Regulation

Footnotes to come.

Here you’ll find the original clips referenced in this episode.

powell shrink bal sht reduce infl CROP

Paul - Galbraith Fed govt unto itself

Galbraith Fed creature cong may 08 2012 davcc

Yellen 2 (davcc)

Merv King - Fed caused inflation ANNO 422 (May 20 2022)

powell june 2020 bal sht no inflation

Galbraith july 09 p28 independence from exec only

Galbraith credentials may 08 2012 davcc

bernanke dual mandate CROP(1)

Bernanke 2 (davcc)

Bernanke 1 (davcc)

Click To Download PDF’s

- Central Bank Independence and Macroeconomic Performance: Some Comparative Evidence

- Federal Reserve Act

- May 8, 2012 – Improving the Federal Reserve System: Examining Legislation to Reform the Fed and Other Alternatives

- May 19, 2023 – Central Bank Independence and Inflation Volatility in Developing Countries

- November 17, 2016 – Hearing Before the Joint Economic Committee Congress of the United States

- Monetary Policy Frameworks: An Index and New Evidence

- June 16, 2020 – The Semiannual Monetary Policy Report to Congress

- A New Measure of Central Bank Independence

- June 22, 2022 – The Semiannual Monetary Policy Report to the Congress

- May 22, 2024 – The Importance of Central Bank Independence

- July 9, 2009 – Regulatory Restructuring: Balancing the Independence of the Federal Reserve in Monetary Policy with Systemic Risk Regulation

Please send to –

John Titus

9660 Falls of Neuse Rd

Suite 138, No. 241

Raleigh, NC 27615

EXTRAS

BONUS MATERIAL

Interview 1929 – John Titus Explains the War for Bankocracy

John Titus Explains the War for Bankocracy ~

The Corbett Report on February 11th, 2025

COMING UP

WATCH ALL EPISODES AS THEY ARE RELEASED

About John Titus

John is a lawyer by training. His work in the alternative media space dates back to the Global Financial Crisis and has taken a few turns.

Professional

John’s legal career began as the ninth lawyer at Roper & Quigg, a litigation boutique in Chicago that represented several Fortune 100 companies in major patent cases. The firm stressed strong writing and courtroom presentations backed up by in-depth research into legal issues and technology.

John’s professional success was greatly aided by his education and background. He has undergraduate and graduate degrees in electrical engineering from North Carolina State University and worked as an engineer at Honeywell. He also worked for two years as the research assistant for the law librarian at the University of North Carolina Law School, obtaining his JD degree with honors there in 1994.

John made partner at R&Q, but after a long string of major successes, the firm was acquired by a major national law firm with a global footprint and a much different culture.

Financial Crisis

John began to apply many of the forensic skills acquired through 15 years of litigation to issues beyond his legal practice, especially the dominant crisis narrative throughout the media, which didn’t add up and ignored altogether the rule of law.

Bailout

In 2010, John began writing what would become Bailout, a feature-length documentary that freely used the term “fraud” to describe what actually drove the crisis. He temporarily left his legal practice in 2011 to oversee the film’s production before returning a year later.

BestEvidence

In 2012, John began learning how to produce videos with his own hands rather than relying on a crew, as he had done with Bailout. Eventually he put his work onto YouTube and other platforms.

Money & Markets

In mid-2020, John caught a major break during the pandemic when Catherine Austin Fitts invited him to co-host her weekly Money & Markets podcast on solari.com Their alliance saw the podcast grow from an audio-only presentation of news events to a high-resolution video format. John has remained with Catherine and Money & Markets ever since.

War for Bankocracy

In late 2024, John pitched The War for Bankocracy to Catherine as a video series with solari.com functioning as both a video-hosting backup service and an online library of research materials and project elements (e.g., video clips from the series).