By testosteronepit

Wolf Richter

The plight of natural gas driller Chesapeake Energy could almost make you feel sorry for the board of directors and CEO Aubrey McClendon. He lost his chairmanship after his conflicted entanglements and an in-house hedge fund seeped to the surface. The company announced it may run out of cash to fund its drilling operations next year. Fitch, in downgrading Chesapeake’s Issuer Default Rating and senior unsecured ratings to BB-, estimated that the shortfall this year alone would reach $10 billion—in the first quarter, the company bled $3 billion in cash—and that it would be forced to dump up to $20 billion in assets to get through this. But Chesapeake’s ability to get new money should not be underestimated during these crazy times when the Fed keeps iron-fisted control of the credit markets with its zero interest rate policy. Investors are dying for yield, at any risk. So Chesapeake got a loan of $4 billion from Goldman Sachs and Jefferies Group to bridge the current hole until some asset sales come through, hopefully. And all due to the low price of natural gas and the ugly economics of fracking.

3rd Quarter 2023 Wrap Up: The “AI Revolution”: The Final Coup d’Etat? (88 pages)

3rd Quarter 2023 Wrap Up: The “AI Revolution”: The Final Coup d’Etat? (88 pages)  Turtle Forth Cap

Turtle Forth Cap  2nd Quarter 2019 Wrap Up: The State of Our Currencies (154 pages)

2nd Quarter 2019 Wrap Up: The State of Our Currencies (154 pages)  What the States Can Do: Building the Legal and Financial Infrastructure for Financial Freedom (64 pages)

What the States Can Do: Building the Legal and Financial Infrastructure for Financial Freedom (64 pages)  2nd Quarter 2021 Wrap Up: CBDCs - Why You Want to Hold On to Your Cash (144 pages)

2nd Quarter 2021 Wrap Up: CBDCs - Why You Want to Hold On to Your Cash (144 pages)  1st Quarter 2019 Wrap Up: Will ESG Turn the Red Button Green? (98 pages)

1st Quarter 2019 Wrap Up: Will ESG Turn the Red Button Green? (98 pages)  2021 Annual Wrap Up: Sovereignty (232 pages)

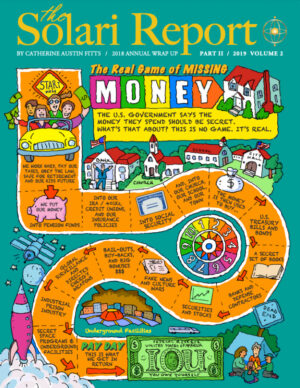

2021 Annual Wrap Up: Sovereignty (232 pages)  2018 Annual Wrap Up: The Real Game of Missing Money, Volume 2 (194 pages)

2018 Annual Wrap Up: The Real Game of Missing Money, Volume 2 (194 pages)  2nd Quarter 2020 Wrap Up: The Injection Fraud (132 pages)

2nd Quarter 2020 Wrap Up: The Injection Fraud (132 pages)