[CAF NOTE: We originally published this on May 7, 2010 under the title of “A Solari Report – The Biggest 2010 Health Care Act Change You Never Heard About: The coming avalanche of business-to-business 1099 Forms” We are moving this post up to the top of the blog because of the number of questions we are now getting about this topic]

Our accounting firm just confirmed the truth of the little-covered story that as part of the new Patient Protection and Affordable Care Act of 2010, (Pub.L. 111-148) (“2010 Health Care Act”).

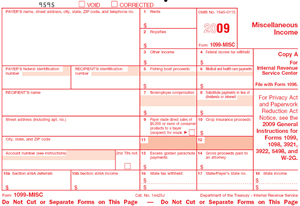

Congress slipped in a provision that requires every non-tax-exempt business in the US to provide by January 31 of each year an information return (usually, a 1099) to every payee to which it makes aggregate payments of $600 or more during a calendar year, effective for 2012.

The May 2010 issue of The Journal of Accountancy provides a short summary of this and other health-care and non-health-care related provisions of the Act.

Under current law, Section 6041 of the Internal Revenue Code (“IRC”) requires businesses to provide 1099s to individuals in a limited set of circumstances (e.g., to consultants like solo-practice accountants and lawyers for services rendered). Click here to see Section 6041 PRIOR to the new changes.

Section 9006 of the 2010 Health Care Act(1) adds two new categories of “payments” for which an information return will be required to be filed with the IRS if the minimum annual aggregate payment threshold is met: “gross proceeds” paid in consideration for “property” or services. The only exclusion from this requirement is payments made to tax-exempt corporations under Section 501(a) of the IRC. In a commentary on the site of the Air Conditioner Contractors of America, its Vice President of Government Relations says that if a vendor refuses to provide a tax information number to the vendee required to provide the 1099, the vendor may be required to withhold on behalf of the IRS. We have not been able to confirm this provision yet, but, if true, a whole new compliance regime would be imposed on businesses of significant size in order to satisfy such a requirement.

Commentators appear to agree that the new reporting encompasses payments for such routine expenditures as rent and the purchase of computers and other equipment, software, office supplies, gasoline and automobiles as well as services like janitorial services, coffee services and express mail delivery services and that we can expect the issuance of hundreds of millions, if not billions, of information returns for which each payor/vendee business will have to obtain tax ID numbers and each payee/vendor business must match to its own accounting and tax records.

Ask yourself how much tax revenue this provision will save in comparison to the costs to businesses of compliance. We think you will conclude that the potential benefits to taxpayers are greatly outweighed by the increased costs in terms of employee time, outside legal and accounting costs, business disruption and general loss of any semblance of business privacy.

Is the goal to so overload small business with compliance costs that you put them out of business? We think so. They will not succeed, but add this to a long list of economic hits from Washington in 2010.

______________

1This provision adds the following new subsections to Internal Revenue Code Section 6041:

(h) Application to Corporations- Notwithstanding any regulation prescribed by the Secretary before the date of the enactment of this subsection, for purposes of this section the term ‘person’ includes any corporation that is not an organization exempt from tax under section 501(a).

(i) ‘Regulations – The Secretary may prescribe such regulations and other guidance as may be appropriate or necessary to carry out the purposes of this section, including rules to prevent duplicative reporting of transactions.’.

and amends Subsection (a) of section 6041 as follows:

(1) by inserting ‘amounts in consideration for property,’ after ‘wages,’,

(2) by inserting ‘gross proceeds,’ after ’emoluments, or other’

(3) by inserting ‘gross proceeds,’ after ‘setting forth the amount of such’.