By Tyler Durden

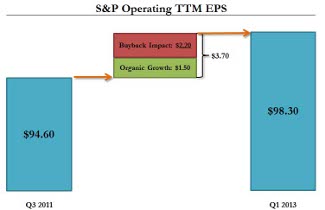

There has been much speculation in the recent past over what the bottom-line impact of surging stock buyback activity has been on the overall S&P earnings: after all, by removing shares from circulation, the denominator in “per share” calculation gets smaller and smaller with every incremental buyback. Courtesy of JPM we finally have a definitive answer to this long-running question. Of the change in S&P TTM operating earnings between Q3 2011 and the just completed Q1 2013, a stunning 60% or $2.20, of all “gains” of $3.70 have been the result of buybacks. The remainder: a tiny $1.50 is due to actual organic growth. This means that nearly 60% of the bridge between the LTM operating earnings of $94.60 as of Q3 2011 to $98.30 at Q1 2013 has come from corporate management teams engaging in shareholder friendly activity.