By Chris Puplava

The decline in bullish optimism towards stocks is usually associated with more severe declines than what we typically see and is likely a result of the chronic market volatility. For example, Bloomberg surveys the top strategists from various investment banks as to their asset class recommendations and the strategists recommended allocation to stocks has, once again, collapsed to the previous 2009 lows. By the time strategists were this bearish towards equities (and indirectly bullish on bonds/cash) in March 2009, the S&P 500 had declined by 57.7%. This is amazing in that it merely took a 9.17% decline to match the same pessimism strategists had at the actual market bottom in 2009.

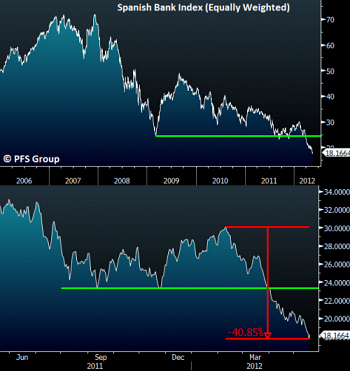

[click on the image for a larger version]