By Chuck Gibson

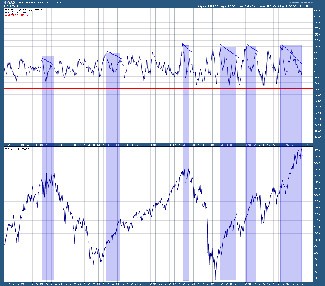

As a part of our regular market analysis we continuously watch the internals to look for structural changes that may provide warning a change may be afoot. Two of the “internals” we follow are the advance decline line and the number of stocks reaching all-time highs.

The AD line measures the number of stocks that are advancing (going up) against those that are declining (going down). It makes sense that over time the AD line must either rise or at least stay flat if the stock market (SP500) is going rise. A basket of stocks like the SP500 index can only continue to rise if the majority of the underlying stocks that make up the index are going higher.