By Jesse Eisinger

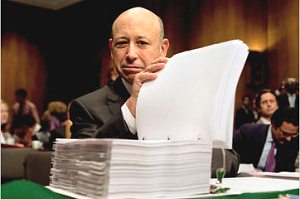

Goldman Sachs appears to be trying to clear its name.

The compelling Permanent Subcommittee on Investigations report on the financial crisis is wrong, the bank says. Goldman Sachs didn’t have a Big Short against the housing market.

But the size of Goldman’s short is irrelevant.

No one disputes that, by 2007, the firm had pivoted to reduce its exposure from mortgages and mortgage securities and had begun shorting the market on some scale. There’s nothing wrong with that. Don’t we want banks to reduce their risk when they see trouble ahead, as Goldman did in the mortgage markets?

Continue reading the article . . .

Solari Report Blog Commentaries

Goldman Gets Subpoena from NY District Attorney

(2 June 11)

Goldman Sachs Offered Libya the Chance to Be Big Shareholder

(31 May 11)

Goldman Is Now A Bigger Credit Risk Than Citigroup

(30 May 11)

Goldman Awaits Subpoenas on Mortgage Operations

(23 May 11)

Will the NY Attorney General Bring Doomsday Charges Against Wall Street?

(20 May 11)

NY Attorney General Seeks Mortgage Records

(18 May 11)

Senate Action Argues for Goldman Criminal Indictment

(12 May 11)