Life gets interesting when the lawyers willing to sue big banks grow in number.

Baltimore is Suing Over Foreclosure Crisis

By Gretchen Morgenson – New York Times (8 Jan 2008)

Lawyers’ fear of being out gunned by the superior legal resources funded by dirty money or sanctioned by the courts and bar associations, as well as their eagerness to succeed within the legal establishment are essential to the triumph of evil.

I got a taste of this in the Hamilton Securities litigation that resulted from my attempt to stand in the way of the housing bubble and billions going missing at HUD. The general counsel of the HUD Inspector General failed in an attempt to falsify evidence against Hamilton after we had an eye witness to her shenanigans provide an affidavit. We produced another affidavit of a former IG auditor who had refused to falsify audit conclusions at the request of the same HUD IG general counsel. The affidavits did not get us anywhere other than stopping the particular frame and inspiring invention of the next attempt to frame. After repeated failures, the HUD IG general counsel got another job — on staff to the ethics committee of a local bar association. Those are the people who manage decisions about whether our attorneys could be sanctioned or disbarred. Chilling.

My new favorite quote (from the HBO series “The Wire” set in Baltimore) touches on this point of gridlock within the system — hinting at the fact that financial fraud, narcotics trafficking and the “non-transparent” economy thrive behind the wall of attorney client privilege and national security secrets.

“If only half of you motherf–ckers in the state attorney generals office didn’t want to be judges, didn’t want to be partners in a downtown law firm; if half of you had the f–cking balls to follow through, you know what would happen? A guy like that would be indicted, tried and convicted and the rest of them would back up enough so we can push a clean case or two through your courthouse. But, no, everyone stays friends. Everyone gets paid. Everyone has a f–cking future.”

So when attorneys in Baltimore (City Solicitor) and Washington, DC (Relman & Dane, PLLC) think they can sue Wells Fargo and still have a “future,” that is news.

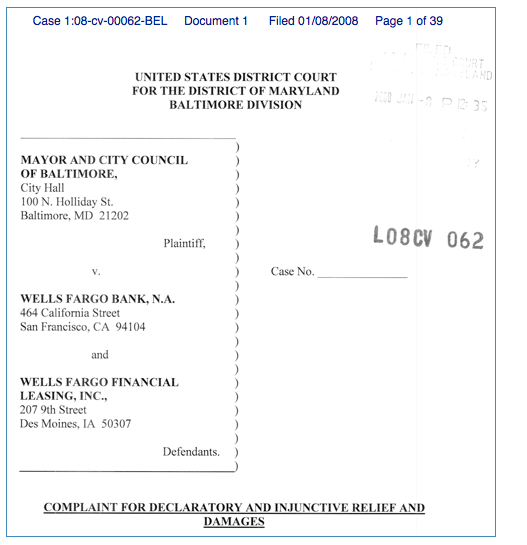

Click the image above to see a full copy of the “Complaint” in Mayor and City Council of Baltimore vs Wells Fargo Bank.

Note the information provided for estimated damages on page 35:

-A study of Chicago communities published in 2006 estimated that each foreclosure is responsible for an average decline of approximately 1% in value of each single-family home within a quarter of a mile.

-A recent study of abandoned homes in Philadelphia found that each home within a 150 feet of an abandoned home declined in value $7,627, homes from 150-299 feet declined in value by $6,810 and homes within 300-499 feet declined in value by $3,542.

-A recent study estimated that total costs to a municipality of a foreclosure ran as high as $34,199 per foreclosure.

This data has profound implications for homeowners and municipalities. According to the lawsuit, nearly 450,000 properties tracked by the MBA were in some stage of foreclosures during the third quarter of 2007 and one out of every seventeen mortgage holders is no longer able to make payments on time.

My husband, Mike Maddy, lost his job at Wells Fargo Reverse Mortgages one month after he was awarded as the number one manage in the nation for Wells Reverse Mortgages. They spent hundreds of thousand of dollars sending the top manages and their wives to the Bahamas in Jan. 08 to reward them. In Feb. 08 they will not renew Mike’s contract stating that they will but it might take a few months. They cut his commissions and salary from $18,000 per month to $3,000 per month and did not offer that promised contract to him for 10 months when they let him go from his job. Meanwhile we have lived on our savings, retirement funds and because of his non=compete for one year have lost everything but our home, which we could loose at anytime. The mortgage is with Wells Fargo and now Wachovia. They have no programs in place to assist us with our $6,000 per month mortgage payments and as of today they keep saying they are going to foreclose if we don’t get caught up.

Wells Fargo not only lied to my husband about a contract being created for him, when they let him go they said it was they needed to make up for the losses they experienced in California on the forward mortgages. Next it is in the news that the CEO of Wells takes 100 million dollar bonus. I guess the $250,000 my husband was making a year was not that much money for them to consider letting him save his job.

Now 1 1/2 years later they have posted my husbands job and he is applying. We pray that they will consider hiring the number one manager in the nation and help us save our house from being taken away from us by the employer who fired him and left us with no income.

Hoping someone out there can understand how our family has been abused by the unethical practices of Wells Fargo.

Cindy Maddy

805 801-8292