By Catherine Austin Fitts

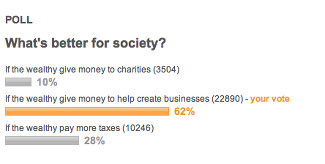

I copied these results from a Yahoo Finance poll that I took yesterday. It is an interesting comment on two important aspects of life in our current situation. I am thinking a lot about them as I prepare my presentation on Crowdfunding this week on the Solari Report.

On the overt side of life, it is a reminder that without goo gobs of government money and intervention, a positive return to the whole depends on a positive return to the people who make it happen. In other words, optimization lends itself to creating self supporting enterprises rather than funding more government. This is something I have written a lot about. I encourage you to read more. See here.

To continue reading Catherine’s commentary on current events subscribe to The Solari Report here. Subscriber’s can log in to finish reading here.

We are entering a period when many philanthropists and donors would prefer a high risk investment to donating funds. Where they donate funds, they will be looking to support things that help build human wealth – such as education and spiritual institutions – which are essential building blocks of any culture and economy.

On the covert side of life, it is important to step back and see the way things are. Using financial fraud, trillions have been shifted out of the reach of governmental obligations, including retirement and health care obligations. This represents the theft of significant assets from individual households. So, let’s say in this financial coup d’etat,

a household lost $250,000 from debasement, missing money from the government, and pump and dump of their housing and the telecom and Internet stocks. Now a portion of that $250,000, say $50,000 will now be laundered back to invest in the business start up by the most talented child in the household. That child will be incredibly grateful for the investment and will remind their parents and fellow family members that the American dream works. Few will appreciate that they just traded a portion of their equity for what was, in fact, supposed to be their inheritance. They will still, no doubt, be better of than their siblings who were not eligible to compete for their former

inheritance.

In every financial wave, there is a complex mix of financial and political crosscurrents. Whatever way we go, it does make sense to optimize. Another way to say it is, when the subsidy flood recedes, it pays to be useful.

Related Reading: