By Gregory White

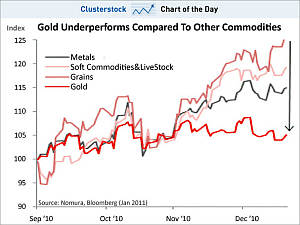

Since quantitative easing 2 really kicked off in early September, one major commodity has lagged the broader market.

Surprise, it’s gold.

And now, with all the talk of inflation striking China, India, and even the United States, you would think the great inflation hedge would be set to surge.

Now Nomura says it may be about to head lower.

That’s because gold’s relationship with U.S. real rates suggests it should lose another 8% of its value, so long as U.S. real rates continue to rise, according to Nomura.