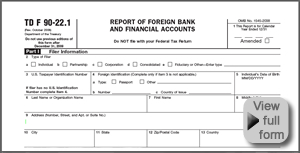

A Solari Report – Foreign Bank and Financial Accounts (FBAR) 2010

“NOTE: This article is intended only as a summary, is not complete and does not constitute individualized tax or legal advice. Investors are advised to seek individual advice from their tax advisors. “

This is a reminder that June 30 is the deadline for most US holders of any foreign financial accounts valued at more than $10,000 at any time during 2009 to file the Report of Foreign Bank and Financial Accounts (Form TD F 90-22.1) with the Department of Treasury in Detroit. Since our FBAR reminder last year, the Internal Revenue Service has issued two forms of guidance, Announcement 2010-16 (“Announcement”) and Notice 2010-23 (“Notice”) and the Financial Crimes Enforcement Network (FinCEN), a Treasury department, has issued proposed regulations.

Last year, persons who had signatory or other authority over but not any personal financial interests in foreign financial accounts got a temporary reprieve from FBAR filing deadline of June 30, 2009. Under the Notice, the filing requirement suspension is extended until June 30. 2011, for covered accounts held during 2010 and before. The Notice and the Announcement provide that those who are not US citizens, US residents or US partnerships, corporations, trusts or estates do not have to file the FBAR for years before 2010. This provision was meant to exclude from the filing requirement non-resident, non-citizens doing business in the US (who, under the 2008 FBAR instructions, were “US persons” required to file).

The original FBAR instructions raised the issue as to whether investments in foreign commingled funds that are not mutual funds are covered by the FBAR filing requirement. It was for this reason that holders of foreign commingled funds of more than $10,000 during 2008 were not required to file last June. The Notice answers this question, at least for the accounts held during 2009 and before: it provides that for foreign holdings prior to 2010, only mutual funds, and not other funds like hedge funds and other private equity funds, must be reported. Presumably, final regulations or other guidance will be issued before the 2010 filing deadline in June 2011 as to whether investors in foreign funds that are not mutual funds must file for 2010. If not, cautious investors in private funds may choose to file.

For this year’s filing requirement, the proposed regulations provide:

(1) Investors in IRAs or 401Ks that have invested in covered foreign accounts are not required to file the FBAR with respect to such accounts.

(2) Trust beneficiaries are not required to file FBARs if the trustee makes required filings with respect to trust foreign financial accounts.

(3) Consolidated FBAR reports may be filed where a greater than 50% holder of interests in an entity that holds covered foreign financial accounts and the entity itself are required to file.

(4) Anyone who holds or has signatory or other authority over 25 or more covered accounts need only provide summary information about such holdings in the FBAR (but must provide Treasury or its delegate detailed information on each account upon request).

(5) Covered accounts include bank, securities and “other financial accounts.” Such other accounts would include only foreign accounts with:

a. Persons in the business of accepting deposits as “financial agencies”

b. Brokers or dealers for futures or options transactions in commodities on or subject to rules of a commodities exchange

c. Mutual funds or similar public pooled funds that have regular value determinations and regular redemptions

(6) Excepted from the filing requirement for signatories over accounts who do not have financial interests in such accounts are officers and employees of:

a. Most banks and CFTC- and SEC-examined financial institutions

b. SEC-registered entities that provide services to registered mutual funds

c. Domestic or foreign entities with equity securities listed on any US national securities exchange

For our readers, we point out the absence of any mention in the definition of “other financial accounts” of precious metals depositories, mints and precious metals dealers that hold currency pending investment and following liquidation, notwithstanding the proliferation of such vehicles. We would, of course, defer to tax preparers for any conclusion as to whether such foreign investments are reportable.

Proposed regulations in general have not been adopted in final form but as a legal matter have significant interpretive value, if not actual force and effect as law. In this case, tax advisors can be expected to rely upon the proposed regulations pending further regulatory action. The comment period for the proposed regulations ended in April. The clear intent is that final regulations will be adopted before next year’s filing deadline and that the final regulations will clarify any questions arising under the proposed regulations. They also may amend the regulations as originally proposed to address industry and other comments. Therefore, we cannot predict what requirements will be in effect next year.

Definition of financial agency from the U.S. Code

31USC 5312(a)(1)

(1) “financial agency” means a person acting for a person (except for a country, a monetary or financial authority acting as a monetary or financial authority, or an international financial institution of which the United States Government is a member) as a financial institution, bailee, depository trustee, or agent, or acting in a similar way related to money, credit, securities, gold, or a transaction in money, credit, securities, or gold.

Links to previous articles on the FBAR

- March 10, 2010, Review of FBAR Regulations

- June 29, 2009, Update – Foreign Financial Accounts: June 30 Filing Requirement for Individuals

- June 24, 2009, Foreign Financial Accounts: June 30 Filing Requirement for Individuals

Additional Information:

Third Question from IRS FAQs:

Q. Is an FBAR required for accounts maintained with financial

institutions located in a foreign country if the accounts hold non cash

assets, such as gold?

A. Yes. An account with a financial institution that is located in a

foreign country is a financial account for FBAR purposes whether the

account holds cash or non-monetary assets.

From: FAQs Regarding Report of Foreign Bank and Financial Accounts (FBAR)