Although it does not appear until almost the end of this article in the Financial Times, BIS Gold Swaps Mystery Unravelled, the source of the gold provided in the dollar swaps with BIS is coming from customers of about 10 European banks who are holding their gold at the banks in ‘unallocated accounts.’

“The gold used in the swaps came mainly from investors’ deposit accounts at the European commercial banks. Some investors prefer to deposit their gold in so-called “allocated accounts”, which restrict the custodian banks’ ability to use the gold in their market operations by assigning them specific bullion bars. But other investors prefer cheaper “unallocated accounts”, which give banks access to their bullion for their day-to-day operations.

3rd Quarter 2020 Wrap Up: Visions of Freedom (104 pages)

3rd Quarter 2020 Wrap Up: Visions of Freedom (104 pages)  2nd Quarter 2020 Wrap Up: The Injection Fraud (132 pages)

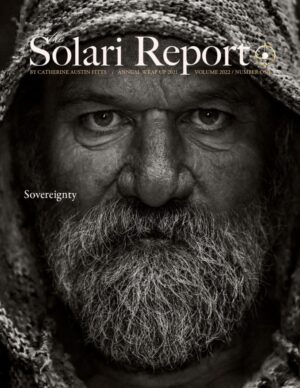

2nd Quarter 2020 Wrap Up: The Injection Fraud (132 pages)  2021 Annual Wrap Up: Sovereignty (232 pages)

2021 Annual Wrap Up: Sovereignty (232 pages)  2nd Quarter 2021 Wrap Up: CBDCs - Why You Want to Hold On to Your Cash (144 pages)

2nd Quarter 2021 Wrap Up: CBDCs - Why You Want to Hold On to Your Cash (144 pages)  1st Quarter 2021 Wrap Up: Take Action 2021 (104 pages)

1st Quarter 2021 Wrap Up: Take Action 2021 (104 pages)