Resources for this week’s Solari Report:

This Week’s Slides:

| Chart 1 | Chart 2 | Chart 3 | Chart 4 | Chart 4a |

| Chart 5 | Chart 6 | Chart 7 | Chart 8 | Chart 9 |

| Chart 10 | Chart 11 | Chart 12 | Chart 13 | Chart 14 |

| Chart 15 |

Read the transcript

Transcript of Equity Market with Chuck Gibson [PDF]

Listen to the MP3 audio file

Download the MP3 audio file

Audio Chapters

1. Introduction & Up-coming Events – 0:00

At Sea Lane – Financial Salons for Changing Times – Sebastopol, 10/20 Santa Cruz 11/14

October 12-14, 2012 Transformations & Renewals Gathering

December 1, 2012 Subscribers’ Luncheon with Catherine Murfreesboro, Tennessee

2. Theme – 1:54

Happy Days are Here Again (sarcastic)

3. Money & Markets – 3:01

In Money & Markets Catherine gives an introduction to the Fiscal Cliff and the monetary, fiscal and government policies coming or in place that will hit your balance sheet and income statement. Catherine also talks about what is happening in the Eurozone, discusses Iranian hyperinflation, and the Asian market slowdown.

4. Geopolitical – 8:00

The big news this week is the first presidential debate of the election season, which Catherine says is proof she cannot get people interested in local elections. Romney recovered some of his lost ground.

5. Science & Technology – 10:10

Catherine discusses the Google driverless car and California signing it into law.

6. Food, Health, & Education – 10:53

GMOs and their safety are still being debated in the news. Catherine also discusses the attack on teachers and education. Teacher pension funds are under attack.

7. Ask Catherine – 12:44

A response to Jon Rappoport’s report from last week.

8. Hero – 14:38

Our hero this week is former democratic pollster and analyst, Pat Caddell.

9. Interview – 15:28

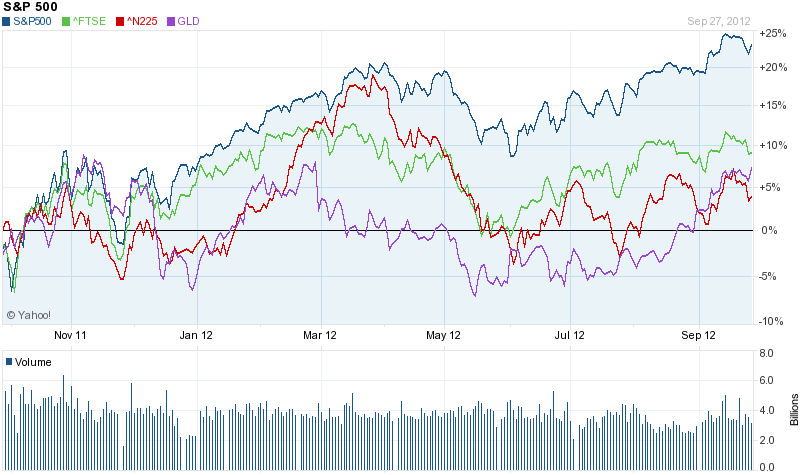

Catherine is joined by Chuck Gibson, her partner in Sea Lane Advisory, LLC in the San Francisco Bay Area. They give their quarterly overview of the equity markets. Key areas Chuck and Catherine discuss are: What QE3 could mean to the equity market and you, what the “fiscal cliff” could mean to the equity markets and you, and the volatility that lies ahead. Find out more in the interview.

10. Let’s Go to the Movies! – 1:33:05

A review of the HBO film, Too Big to Fail

By Catherine Austin Fitts

This Thursday on The Solari Report: our quarterly overview of the equity markets. I will be joined by Chuck Gibson, my partner in Sea Lane Advisory, LLC in the San Francisco Bay Area.

North American equities have had quite a strong year, but it looks like that strength may be over. Earnings do not support rising prices. However, central bank interventions in the U.S., in Europe, and in Asia do. So what’s next?

Key areas Chuck and I will be discussing:

- what QE3 could mean to the equity market and you,

- what the “fiscal cliff” could mean to the equity markets and you:

- the volatility that lies ahead.

We will be using slides on the webinar software, so if you are listening live, you may want to follow along in your browser. Slides will be posted in links in the subscriber space on this blog post on Friday.

Check out my Solari Report interview with Chuck this summer “View From Silicon Valley”. It’s excellent background on the innovation and technology trends that have contributed to surprising strength in U.S. equity markets this year.

I will start with Money & Markets and Ask Catherine. Subscribers can post their questions here or live Thursday evening.

In Let’s Go to the Movies: a review of Andrew Sorkin’s fictionalized account of the 2008 bank bailouts, Too Big to Fail.

Talk to you Thursday!

Catherine & Chuck,excellent material presented here. Chart data very revealing . Keep up the fine work.

Most everyone I know that has been foreclosed on lived in the home for at least a year before being evicted, 2200×12=26,400. Not a bad uptick in disposable income for a stone. Of course that worked out real good for retailers for the last 4 years or a nice down payment on a smaller more affordable home but that train is running out of track too. Other then that as George Carlin said; “It’s a big @*!*# club and you ain’t in it”.

Comment to Robert ….

The ‘tax penalty’ is known as ‘debt forgiveness’ … which has been applied until (I believe 2008) when so many people were losing their homes that Congress enacted a temporary measure that would exclude certain foreclosures and short sales … and Yes! they did go after people prior to 2008. The lender who lost money would calculate their loss and issue a 1099 to the foreclosed homeowner for the amount of the loss. So people would lose their homes, be also liable for the lender losses (on ‘recourse loans’) and then any additional losses would cause a 1099 to be issued to (against) the homeowner. It was a huge problem in the 1990’s and, unless Congress extends this provision, it will affect hundreds of thousands of sales every year – both foreclosures and short sales.

Great job tonight! I so appreciate the ‘look ahead’ that you consistently bring to the Solari Report. The Big Squeeze in 2013 for the huge tax increases, combined with reduced spending and cutback on Social inSecurity are very important for me to correctly position the advice that I give to my clients (and for myself). Instead of getting broadsided along with everyone else, I have time to prepare, advise and endure!

Tonight’s Solari will require more than my usual 4 re-listens … probably everyday for the next week! Thanks again, Catherine … and they say in my son’s karate class when someone achieves excellence – ‘You Rock!’

Regarding the “tax penalty” for walking away from a mortgage:

If the bank forecloses on you and takes your house away, you have lost the collateral for the loan. You have lost your house. Are you guys saying that the government views losing your home as a BIG PROFIT?

Is the government going to GO AFTER all the unfortunate people in this country who have lost (and been kicked out of) their homes? How can they expect to “get blood out of a stone” from all these people?