“Usury once in control will wreck the nation.” ~William Lyon Mackenzie King

By Catherine Austin Fitts

When the history of the failure of the United States is written, the virus that brought the empire to its knees will be financial criminality and usury.

The NY Fed, a privately owned back that serves as depository of the US Government and agent for the Exchange Stabilization Fund, has systematically run the government accounts outside the law – $21 trillion is missing from the US government as of 2015, after which the US government adopted a policy of keeping its books and accounts secret.

The NY Fed and its member banks are legally liable – both for the $21 trillion as well as for stuffing our pension funds and retirement accounts with worthless paper in a manner violating securities laws. If you hear proposals that ownership of the NY Fed should be transferred to federal control, beware a transfer of $21+ trillion of liabilities to protect the private owners from having to return their winnings.

The NY Fed members banks can today borrow at 0-1% using our credit. With a 0% reserve requirement, they can create money out of thin air on a near infinite basis. But the average credit card holder in American pays 17+%. This is usury. It used to be illegal. The day it was made legal was the day that America’s failure became a fait accompli. It’s the magic of compound interest.

The current coronavirus “plandemic” in one sense is a cover story. There is indeed a virus destroying the world – financial criminality and usury. Now that it is destroying the dollar system, the same players are marketing new digital systems. The idea is that once they have wrecked the global economy at great profit to themselves, we can look to them to bring up a new system.

Good luck with that.

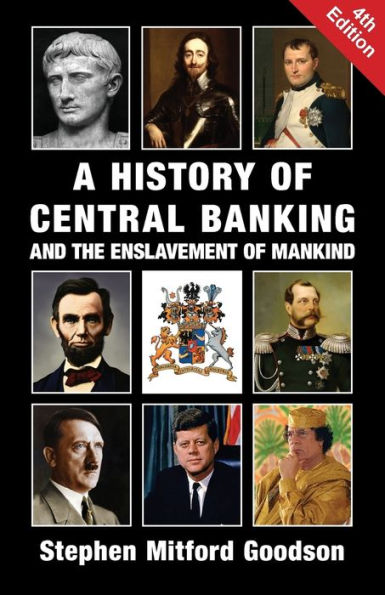

Stephen Mittord Goodson’s 4th Edition of A History of Central Banking and the Enslavement of Mankind is a unique look at the devastation that has been wrought through the centuries by privately owned central banks and the privileges their shareholders claim. It is a rare history not funded or written by the private owners of the central banks and the universities and think tanks they control.

If you want to understand why a world so blessed with wealth could become so poor so quickly, this is a book well worth reading.

Related reading:

Stephen Mitford Goodson on Wikipedia

Books by Stephen Mitford Goodson

Caveat Emptor: Why Investors Need to do Due Diligence on US Treasury and Related Securities

Really looking forward to reading this. Thanks for the review.

For a slim 130+ pages of easy reading, this book was a revelation of tectonic proportions and implications. I consider myself informed in the history of banking (having read J.P. Farrell’s Vipers of Venice and Babylon’s Banksters), but Goodson’s analysis on the effects of Central Banking and his thesis that private, debt-based CB is in effect a form of slavery, is outlined with example after historical example. Well researched, well reasoned and lacking in emotional vitriol. One gets the sense that Goodson would be uttering under his breath “How do they get away with it?”, but he knows enough to have a clear answer to not need to ask the question. To this day, as an American, I am baffled by our lack of a State Bank where I live (North Dakota is a wonderful model of how things should work). Time to get to work on making that a reality in Washington state.

State banks, local currencies, gold and silver to trade without sales take, local encrytion, local equity pools….I could go on. This was all known in the 1990’s and before. In the middle of the great depression there were 3100 local currencies. That is why they needed the big fed programs – to knock out thriving local companies developing with local currencies.

The more and more I find about place-based economic optimization, the more I realize “I’m the patsy”. From what I remember from high school history and college, the idea was always spun that the boom-bust cycle was due to all the different currencies in use across the US. Now, seeing it from the rear-view mirror (as always) I realize what an absolute load of rubbish it is and how Mr. Global is debasing all that it touches. And why not? The less you can trust the experts, the more you won’t know where to turn…until you actually take the time to think and research.

Math is such a wonderful tool in the hands of a free, honest mind! Stay calm and do the math….