by Adam Brochert

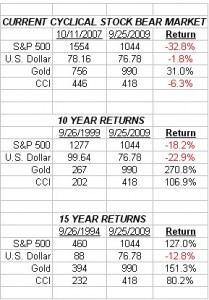

In the end as an investor, it’s all about the scoreboard. For those who aren’t traders, allocation to the correct asset classes is critical to long-term returns. Following are the returns for the S&P 500, the U.S. Dollar (using the Dollar Index as a proxy), Commodities (using the Continuous Commodity Index [$CCI] as a proxy) and Gold. These returns ignore dividends, yields, and expenses, which are important concepts over the long-term and make this a less than ideal comparison. You can plug in whatever figures you think are appropriate and make your own comparison(s) if you’re so inclined.

Continue reading Asset Class of the Decade: Gold