By subscribing to The Solari Report you will gain access to member’s only content like this post.

[Note from CAF: I got this question from a subscriber this evening, so I asked Paul Ferguson to prepare a comment. Here is the question: Hello Catherine, I am new to the Solari Report. I first heard your name from Damen Vrabel on his Renaissance 2.0 presentatiion. He gives you the credit for his information on banking and the Fed. My question to Franklin : I have some money in [Mining Company]. It has really taken a hit lately. I realize it is a long term prospect, but you talk about the phases of a mining company such as exploration time, infrastructure buildout, and production. More importantly, what part of a the mining cycle would you advise a person to start buying its stock? I realize all mines are not a like, but patience can be tested with a company like the one I bought. Thank you.]

By Paul Ferguson

The other day we received an e-mail from a subscriber asking about the development phases of a mining company and when is the best time to purchase shares. We thought we would take that as an opportunity to say a few words about mining shares.

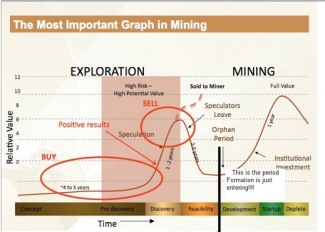

The chart below shows the typical life cycle of a junior mining stock (click it to see a larger version). Over the past few years though, timelines have lengthened considerably, so the amount of time for each phase may vary from how it is depicted in the chart and in most cases it will be longer, not shorter. That said, the two optimum points for investment are obvious on this chart.

The lengthening timelines were just one of the challenges and headwinds facing gold mining companies as identified by Pierre Lassonde in the presentation he gave this year at the Denver Gold Forum. Those challenges include:

- Declining ore grades and rising production costs

- Rapidly decreasing ROI into Exploration – fewer discoveries despite increased investment

Rising country risk: taxes, royalties, expropriation - Lengthening timelines – In the 1980’s it took 5 years or less to get from discovery to production, now it takes about 20 years

- Perenially bearish industry analyst gold price forecasts: these always make gold mining look like a business with a grim future. Analysts should refrain from being always wrong but never in doubt.

Gold remains off the radar for mainstream investors. Like generals fighting the last war, they got caught up in the Facebook IPO and retail money continues moving money into bond funds even as that bull is well past its mandatory retirement age.

Gold continues to represent a minuscule fraction of global financial assets. If this bull market progresses along a trajectory similar to the historical precedent, then despite the challenges for gold mining companies, much higher prices for their shares lie ahead. As usual, perhaps it’s not different this time.

For investors who lack the time, expertise or inclination to thoroughly research and then stay on top of individual mining companies there are several ETF and mutual fund alternatives out there that can provide exposure to gold mining but in a way that allows you to spread the risk across multiple companies. Because mining is such an inherently difficult business, even when everything is going smoothly, it is imperative to manage against individual company risk.

By the end of his trading career, Jesse Livermore, widely considered to be one of the greatest traders of all time, believed that the way to the greatest success in the market was not to try to time short-term reactions but to identify a bull market early on, get on it and stay on it for the duration. It is a difficult, but not an impossible challenge.

Learn more in this weeks’s Solari Report