A new Solari Special Report, FBAR Developments for Individuals for the 2013 Tax Year.

A new Solari Special Report, FBAR Developments for Individuals for the 2013 Tax Year.

By Carolyn A. Betts, Esq.

Excerpt:

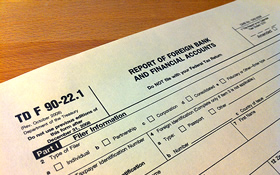

The requirements for individuals to file the Report of Foreign Bank and Financial Accounts (“FBAR”) have changed for the 2013 tax year. To remind readers, the FBAR for a calendar year is due the following June 30, and there is no provision for an extension. However, information about the same holdings is included in the annual income tax return that is due April 15.

To continue reading this Special Report subscribe to The Solari Report here. Subscribers can log in to finish reading here.

Download/read the PDF file of the article.