By Eugen von Böhm-Bawerk

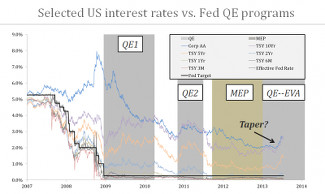

Something peculiar has been going on in the treasury market during the latest round of quantitative easing (QE). If we study the chart provided below we find that treasury rates increased as soon as a QE-program was enacted, and fell immediately after its termination. Take the TSY 10 year for example; as soon as QE1 was implemented rates rose rapidly from a low of 2.08 per cent to a high of 4.01 per cent. What is striking about this is the fact that the low was set three days into the program, while the high was set three days after the program. A similar development occurred under the QE2 program. Rates reversed their sharp downtrend from the peak set around the end of QE1. A notable difference in the QE2 cycle was the apparent front-running by the market. Investors had obviously learnt how QE impacted various asset classes, so the rate peak came at the middle of the program, not at the end as witnessed under QE1. Still, the collapse in rates right after the program ended was significant.