By Jesse

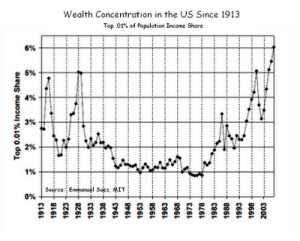

Those who have taken a huge share of the last three bubbles would like to stop the bubble now, keep their gains, and return to a system of fiscal restraint with light taxation on their windfall of assets.

So why does this not just simply happen? Because the political risks become enormous. It is difficult to reduce a population of free men into debt slaves, without risking a significant reaction. Therefore, it seems most likely that the government and the Fed will try to ‘muddle through’ for the time being, and look for an exogenous event to break the stalemate.

The traditional solution has been a military conflict, which stifles dissent against the government while generating artificial demand sufficient to energize the productive economy. It is a means of exporting your social misery, official corruption, and fiscal irresponsibility to another, weaker people.

Continue reading The Speculative Bubble in Equities and the Case for Deflation, Stagflation and Implosion