Listen to the MP3 audio file

Download the MP3 audio file

Read the transcript

Transcript of Catherine’s 4.19.12 interview of Jim Norman [PDF]

Audio Chapters

1. Introduction & Theme – 0:00 – Theme: A Hot Time in Latin America; Catherine is heading to Portugal on Friday, intending to get a better understanding of what is happening on the ground in Europe; there are serious international tensions. …

Subscribers, have lunch with Catherine:

- in Lisbon, Portugal – Sunday, April 22

- in Cincinnati, Ohio – Saturday, June 30

You may bring one guest. RSVP to communicate@wordpressdevurl.com with the following information:

- Luncheon you wish to attend

- Date of the luncheon

- Names, phone numbers, and e-mail addresses of those attending

Find more details at the Subscriber Luncheons with Catherine webpage.

2. Money & Markets – 04:12 – Markets trading sideways. Vatican scolding Catholic nuns; Christine Lagarde cheerleading for the IMF. Feel free to vote for a third party, independent or write in is a powerful thing. State and Local elections are powerful – particularly if you can turn out in debates, discuss with your neighbors, give campaign contributions …

3. Solari Hero – 07:44 – Chris Powell of GATA (last week’s Solari Report); see Solari Report article GLD and SLV: Disclosure in the Precious Metals Puzzle Palace …

4. Ask Catherine – 09:45 — What about Eric Sprott and his Gold and Silver Trusts? Where is the real weakness in the system? Lack of the “Mandate of Heaven”; controversy over the film THRIVE; material omissions; controlled opposition …

5. Interview – 23:25 – Jim Norman – What is going on in terms of real domestic oil and gas policy and production? Is the oil price being kept high to checkmate China, but the natural gas price being kept low to preserve the dollar and US competitiveness? Boom times in Midland, North Dakota. The Keystone pipeline: What are the facts, what are the politics, what do you think will happen. What will it mean to the dollar and US trade balance. Update on the Gulf. What’s happening in Alaska, including rumors about the Liberty rig. …

7. Let’s Go to the Movies – 1:05:36 – The Hunger Games – I am gravely concerned about the popularity of “Hunger Games”. Conditioning a people to kill one of your own brings back memories of Rwanda in Spring 1994 when Hutus decided to eradicate the Tutsis who were neighbors, fellow Catholics, relatives and household members all in the name of “social revolution”. Seven people killed per minute for just over 100 days. Conditioning young people to get used to the idea of killing their own is never a good idea and will not serve this culture well. …

6. Up Next & Closing – 1:10:38 – May 3, Introduction to Solari Report resources for new subscribers; May 10, Precious Metals Market Report with Franklin Sanders …

“The trouble with this country is that you can’t win an election without the oil bloc, and you can’t govern with it.”

– Franklin D. Roosevelt

By Catherine Austin Fitts

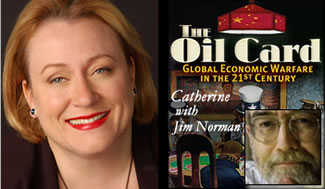

This Thursday, veteran journalist and author Jim Norman joins us to talk about the energy markets. What is happening in the oil and gas industry and what does it mean in terms of geopolitics and financial and commodities markets?

Jim is the author of The Oil Card and, after Franklin Sanders, has joined us on the Solari Report more than any other commentator. (See blog posts: May 19, 2011, June 17, 2010, March 19, 2010.) I consider Jim’s unique insight into what is happening in the energy world to be invaluable.

A question I have asked for the last several shows is about the possibility of an “American Renaissance.” Is such a notion fact or fiction? The dollar remains relatively strong and the pundits are out extolling the virtues of American corporations, ignoring the dependency of their earnings on government and central bank intervention.

Perhaps the most important question for the US economy is whether the growing oil and gas reserves will make America both self sufficient and competitive.

- Can a high oil price checkmate China, while a low natural gas price keeps American manufacturing competitive in the global markets?

- And what about all the impact of new technologies – whether in the oil patch or in renewable energy?

We will also get an update on the clean up in the Gulf and the politics of the Keystone XL pipeline and discuss how the oil industry will line up in the fall elections.

I will start with Money and Markets and Ask Catherine.

In Let’s Go to the Movies, a comment on the popularity of Suzanne Collin’s movie adaptation of her book, Hunger Games.

[arve url=”http://www.youtube.com/embed/mfmrPu43DF8″ frameborder=”0″ width=”325″ height=”215″>

YouTube

Talk to you Thursday!