By Garry White

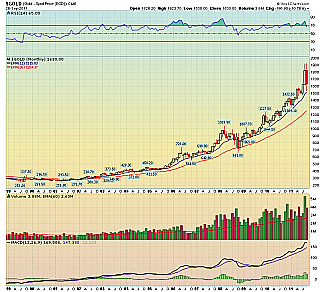

The gold price plunged $60 at the open after CME Group said it would increase its margin requirements from the close of business on Monday to cover itself as increased volatility makes losses more likely.

CME, the world’s largest futures market, said it will increase the collateral requirements for gold by 21pc, silver margins by 16pc, and copper margins by 18pc.

Continue reading the article . . .

Related reading:

Why did Gold and Silver Plunge? No, It’s Not CME Margin Hikes; What will the Fed do Next?

MISH’S (24 Sep 11)

How Gold Performs During A Financial Crash

Seeking Alpha (23 Sep 11)