Similar Posts

Biodynamic Gardening Workshop

The host of this workshop is a personal friend of mine. If you are in the Ashland area, you might want to take it in.

It’s springtime! And I urge everyone everywhere to search out the many activiti…

Chavez Orders $11 Billion of Gold Home

By Daniel Cancel and Nathan Crooks

Venezuelan President Hugo Chavez ordered the central bank to repatriate $11 billion of gold reserves held in developed nations’ institutions such as the Bank of…

The Climate Change Climate Change

Associated Press – Steve Fielding

Steve Fielding recently asked the Obama administration to reassure him on the science of man-made global warming. When the administration proved unhelpful, Mr. Fiel…

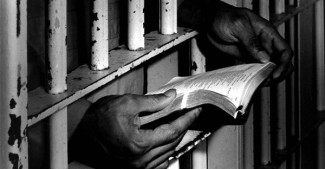

Homan Square: Is Someone Prototyping Domestic Rendition?

“Verily I say unto you, Inasmuch as ye have done it unto one of the least of these my brethren, ye have done it unto me….For I was an hungred, and ye gave me no meat: I was thirsty, and ye gave me n…

Announcing MicroHouse Collaboration 2014

By Catherine Austin Fitts

Chris Reinhart is now leading the MicroHouse program for Open Source Ecology (OSE) full time. OSE has exciting plans for workshops in 2014. If you and yours would like to …

6 Comments

Comments are closed.

Thanks Katherine!

Good to speak with you yesterday on KPFA about the dangers of hyperleveraging when coupled with criminal intent.

Unfortunately, the testimony I was referring to above was the semi-annual Humphrey Hawkins testimony of the Fed before the Senate Banking Committee. Some Senators seemed genuinely perplexed during the question and answer period about how could things have gone so wrong at the GSEs because they had such “good management”. One would hope that such an august body would not be so clueless.

Good managers never would have leveraged themselves at 60 to 1 when all their models such as Black Scholes assume a Gaussian distribution of prices and outcomes but, as Paul Volcker pointed out a few months ago, we keep having these sigma 4 events every 10 years and each one is worse than the one before.

You mentioned yesterday that FHA was hypothecating the same security multiple times in some of their CDOs. How widespread was that crime?

Did this occur at Fannie and Freddie also?

Thanks so much.

Matt in Burlingame

Matt:

Typically, the goal of hearings such as you refer to are OTHER than illuminating or educating. For example, goals may be to generate support for a “reform” or look like “something is being done” or to engineer support for changes.

To the extent that the derivatives are ignored for sincere reasons, it is often because easy to understand information on derivatives and derivatives portfolios are typically not available.

Best,

Catherine

Catherine, I enjoyed speaking with you yesterday on KPFA. I was the gentleman who emphasized the DEFLATIONARY aspects of this catastrophe.

Catherine, as I listen to the Senate hearings today on Fannie and Freddie reform legislation everyone seems to be missing one of the most basic causes of what pushed us over the cliff.

After the Glass Steagal Act was passed in 1933, the margin requirements for stock purchases was raised to 50%, because it was clear that purchasing stocks on just 5% margin contributed to the rapidity of the Great Crash of 1929.

However the bond and derivatives DWARF the puny stock markets in size. For example, the notional value of the derivatives markets is routinely estimated at around 450 TRILLION dollars.

Yet Bear Stearns was leveraged at a 30 to 1 ratio and FNMA and Freddie are operating at 50 to 1 leverage, according to the FT.

This hyperleveraging is profoundly destabilizing. Why do so many people ignore this elephant in the room?

Matt

James:

This could only happen with Federal Reserve leadership. However, building this kind of bubble requires many institutions to also lead or go along.

Catherine

Catherine,

On last Wednesday’s flashpoints (which was the best one yet!) you

said the characteristics of a bubble economy are:

-encourage speculation

-which in turn drives assets up

-which in turn attracts capital

-then capital is pulled out of area

My question: isn’t the federal reserve at the helm here, enabling speculation with their

inflationary management of the economy?

Catherine,

Is not the federal reserve at the helm of all this centralization, inflating/devaluing the dollar

with money/credit expansion and enabling all the other actors like Freddie Mae to compound it all

or is this oversimplifying?

After all having a central bank is the antithesis of a free market.