Capital is slowly withdrawing from the American housing stock.

We are transitioning from a model in which most Americans think of their homes as an investment, to one in which housing is a consumptive good. There is lots of news and most of it is bad for housing.

Price inflation means maintenance and energy are more expensive. Food too. The reality is that people are going to buy food and pay their heating bill before owning a bigger house. Some are going to rent. Some are moving in with friends and family. Some are going homeless. More young people are learning how to build their own.

Federal deficits mean programs that support households get cut. Subsidies to help seniors with heating bills get cut. Cost of living increases don’t happen. Federal cuts put more pressure on state and local budgets. State and local deficits mean pressure on taxes and local services and more unemployment. As the municipal bond markets get hammered, there will be fewer tax-exempt bonding proceeds for residential construction and mortgages. What remains will pay a higher price.

Weird weather means more deterioration and repairs. And it’s hard to market homes in a blizzard.

Rising interest rates and the end of the bull market in bonds means that mortgage markets are going to have a much tougher time competing for capital. When financing costs go up, housing prices go down.

Oh, and now the federal government has decided to wind up federal support through Fannie Mae and Freddie Mac, which provide financing to a lions share of the residential mortgage market. That will leave FHA and Ginnie Mae, which means significantly less federal credit for the mortgage market, particularly the middle and upper income part of the market.

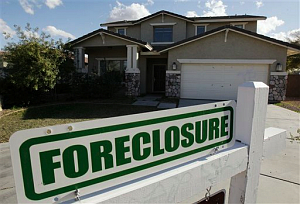

Meantime, the foreclosure system is so corrupt that even a governor of the Federal Reserve is calling for fundamental reform.

And, if the MERS system (critical to making systemic mortgage fraud go) is deemed to not have the right to transfer mortgages outside the local process, as one US federal bankruptcy judge just determined, watch out for the foreclosure pipeline to turn into a worse mess.

Much of the growth of housing as been an increase in the average per square footage and the home ownership rate. This is reversing. Get ready for smaller spaces and a decline in the home ownership rate.

Here are recent stories from the blog that when viewed together underscore the multiple pressures on the housing and mortgage markets.

Solari Report Blog Commentaries

MERS Lacks Right to Transfer Mortgages, Judge Says

February 15, 2011

Krugman on the Budget & the Red Button Problem

February 14, 2011

Imagining Life Without Fannie and Freddie

February 13, 2011

Morales Flees Food Price Protests

February 13, 2011

White House Plans to Revamp Mortgage Market

February 10, 2011

An Era of Cheap Food May be Drawing to a Close

February 6, 2011

Global Food-Price Index Hits Record

January 6, 2011

From Recent Top Picks:

Roubini’s Next Crisis Makes Food for Thought: William Pesek

Yahoo Finance (13 Feb 11)

Fed Official Calls For Major Foreclosure Reforms

The Huffington Post (15 Feb 11)

Largest Bond Fund, Pimco, Cuts US Government Holdings

GATA (14 Feb 11)

Gross Cuts Government Holdings to Lowest Since 2009

Bloomberg (14 Feb 11)

Muni Fund Investors Pull $1.2 Billion in 13th Week of Outflow, Lipper Says

MISH’S Global Economic Trend Analysis (12 Feb 11)

City Budgets Put States on Edge

The Wall Street Journal (12 Feb 11)

White House Expects Deficit to Spike to $1.65 Trillion

The Wall Street Journal (14 Feb 11)

Real Estate News: Rise in Rates Is Headwind for Housing

The Wall Street Journal (11 Feb 11)

Rental Market Gets Respect in Fannie, Freddie Reform

The Wall Street Journal (11 Feb 11)

Companies Stock Up as Commodities Prices Rise

The Wall Street Journal (3 Feb 11)

Food Riots And The Mass Liquidation of Foreign Exchange Reserves

Market Skeptics (21 Jan 11)