A Preview:

Solari North American Video Server

The combined wealth of U.S. billionaires has surpassed $1 trillion in gains since March 2020 and the beginning of the pandemic, according to a study by the Institute for Policy Studies. ~ Institute for Policy Studies, December 9, 2020

By Catherine Austin Fitts

Happy New Year!

This coming week, we begin publication of the 2020 Annual Wrap Up. Last year was an unusual year by all measures. By looking back, we can identify the trends that promise to shape the year ahead.

This Thursday, on January 7th, we will publish the 2020 Annual Wrap Up Equity Overview. I will be joined by financial advisor Tim Caban, President of Copper Beech Advisors, LLC. Tim is one of the financial professionals who has made an effort to integrate “real deal” risk issues to help build family wealth. We will review market performance for 2020, including the intersection of Covid-19 policies with the fixed income and equity markets.

Interest rates remained low, while Covid-19 helped push gains on bonds to unexpected levels.

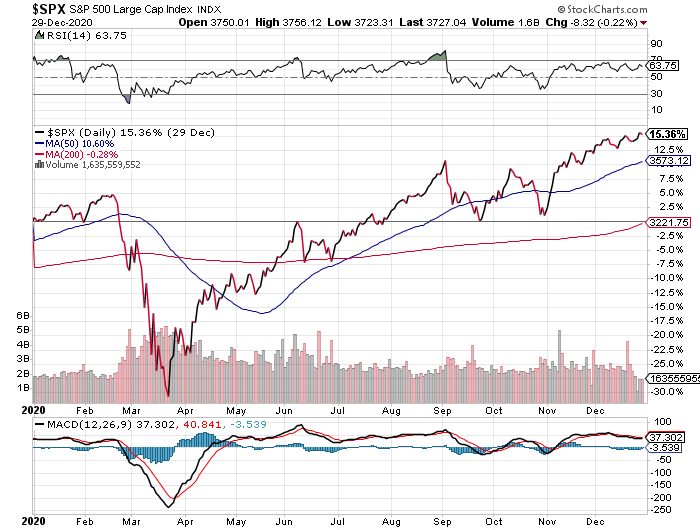

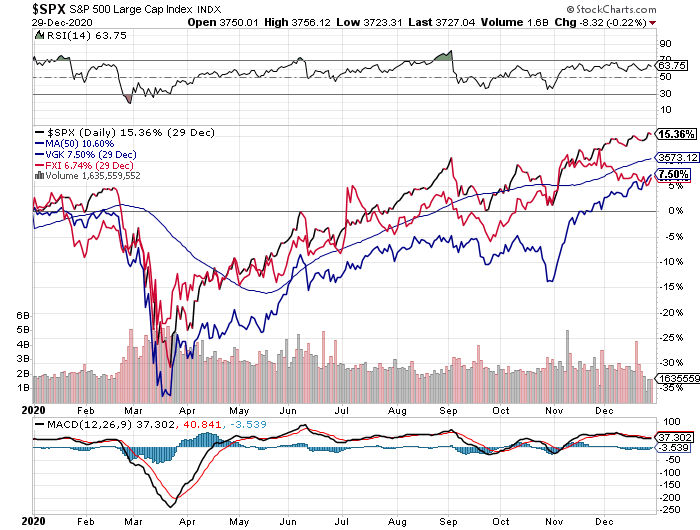

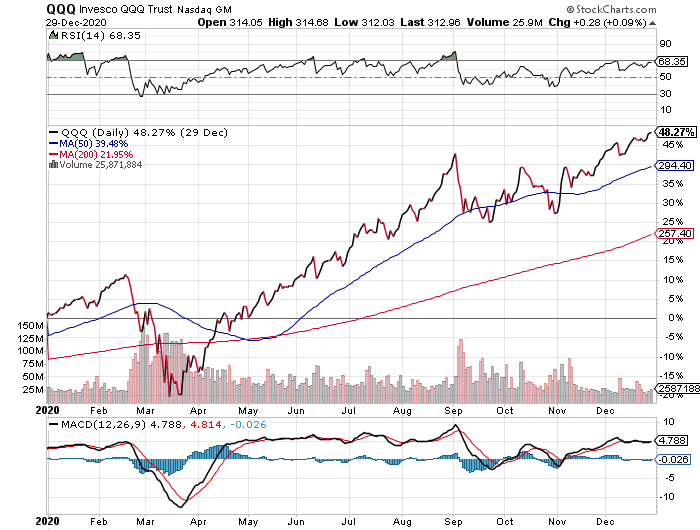

After a significant drop in the first quarter, the stock market rallied on waves of central bank and government stimulus justified with Covid-19.

Thanks in no small part to Covid-19 QE and stimulus, U.S. stock markets outperformed European and Chinese counterparts.

Value stocks continued to significantly underperform, while growth stocks enjoyed the “bubble” supported by the ongoing fusion of the military-industrial complex with Silicon Valley and Biotech.

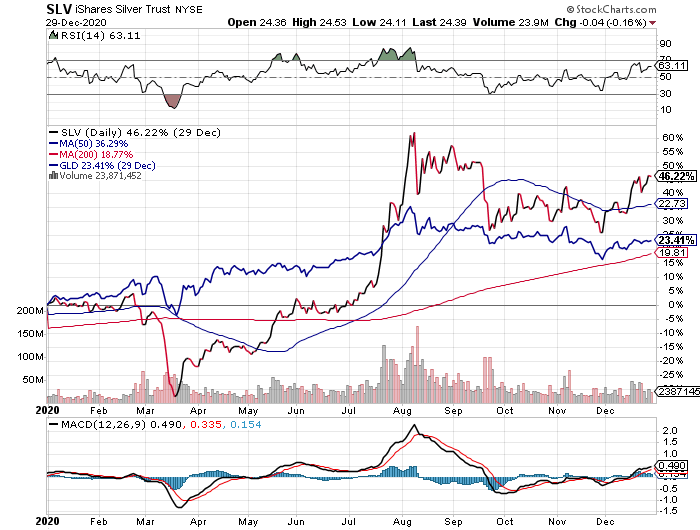

Precious metals had another good year, reflecting the deterioration of faith in governmental institutions and concern about extraordinary stimulus and real asset inflation.

Make sure to check out the full presentation of annual financial charts and the new Rambus Chartology at the 2020 Annual Wrap Up web presentation when it publishes on January 7th.

Tim and I will review additional trends that marked the year; winners and losers; whether equity investors have been keeping up with inflation; the long-term impact of the deterioration of sovereign government credits; and the possible market impacts of 2021 lockdowns, threatened “Covid tsunamis,” and changes in the U.S. Congress and administrations. I will also describe our scenarios for 2021 planning.

On January 14th and 21st, Dr. Joseph P. Farrell and I will present News Trends & Stories for the 2020 Annual Wrap Up. In Part I, we will look at the top 10 stories of 2020 in Economy & Financial Markets and Geopolitics as well as the Trump Report Card. In Part II, we will cover the top 10 stories in Culture; Science & Technology; Space; and Food & Health. We will also discuss Unanswered Questions, Inspiration, and Take Action.

Finally on January 28th, John Titus will join me for his presentation of our 2020 Annual Wrap Up theme: “Going Direct Reset—Central Bank Owners Make Their Move.”

In Let’s Go to the Movies, I will review the winner of the Solari Report Documentary of the Year for 2020: My Octopus Teacher. This documentary reminds us that we live on a magnificent planet. Earth’s spectacular beauty and varied living beings can nourish our wisdom and heal our body and soul.

In Money & Markets this week, I will cover current events with John Titus and touch on some of the financial and geopolitical news to watch for in 2021.

Post your questions for Ask Catherine and story suggestions for Money & Markets with John Titus for this week here.

Please join me this Thursday January 7th for the 2020 Annual Wrap Up: Equity Overview.

Talk to you Thursday!

Related Reading:

Recommended: Tuesday, January 12, 2021, Jeffrey Gundlach, Just Markets webcast titled “Aqualung“ at DoubleLine