“Always be nice to bankers. Always be nice to pension fund managers. Always be nice to the media. In that order.” ~John Gotti, American gangster and head of the Gambino family

By Catherine Austin Fitts

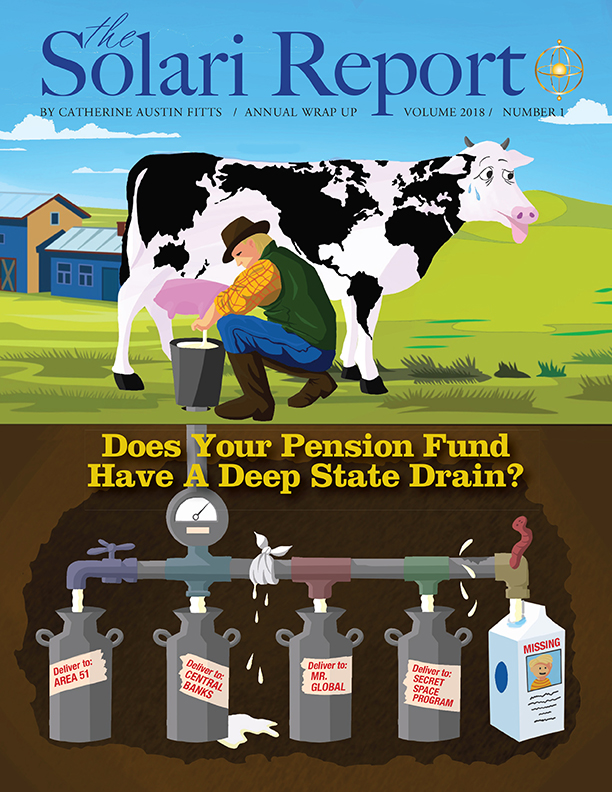

This week on The Solari Report, I present the theme for the 2017 Annual Wrap Up – “Does Your Pension Fund Have a Deep State Drain?”

It’s time to change the narrative on pension funds. From 2009-2012, we funded over $20 trillion for the bank bailouts. There is $21 trillion missing from DOD and HUD since fiscal 1998. Trillions more dollars have gone for quantitative easing. And more dollars are lent to big banks at the Fed window at interest rates lower than 1% interest. And we can afford lower tax rates and bigger military budgets.

At the same time, pension funds are underfunded and there is – or so we hear – a crisis. Despite the laws and regulations to keep pension fund properly funded, we are told they are not fully funded. And, depending on what estimates you read, we are told we can not possibly find a few trillion to address shortfalls in the pension and retirement systems. And indeed, retirees are beginning to experience cuts in their benefits.

I struggle to find the logic in here. We can gift or lend $20 trillion to private banks to which we have no legal or contractual obligation to do so and to which approximately 80% of the population is opposed, but we cannot fund legal and contractual obligations to our own citizens. Why?

There are other riddles in the official pension funds narrative.

Countries such as Norway, Denmark and the Netherlands can manage changing societies and financial markets, can make reforms, and can take actions that deliver solvent retirement systems. Why the government which runs the worlds reserve currency do the same?

Some corporations, hedge funds and private equity investors are promoting products, services and activities that seriously harm our environment, general population and economy. Why are pension funds financing them? For example, why are pension funds financing companies that create expensive addictions because they make money for that company? Surely large pension funds have the strategic breadth to understand that creating an addicted population will detract from long-term performance.

Finally, circumstantial evidence suggests that boards and trustees do not fully control pension fund policies, which are heavily influenced by powerful outside forces. The governance of pension funds has been compromised. If the integrity of pension fund governance is compromised, are investments and returns also compromised? Do pension funds, like so many other institutions, have a deep state drain?

My goal is to ask questions about pension funds that can help us bring real insight into what is happening to us.

This section is the last of our 2017 Annual Wrap Up. Check out News Trends & Stories, Part I and Part II as well as Equity Overview, Precious Metals & Rambus Chartology. As we complete our web presentation, you can look forward to our pdf and flipbook which will be published in February.

This week is the last week of the month, so no Money & Markets. Email or post your questions for Ask Catherine and I will answer the following week.

If you want an inspiring movie recommendation, check out Breathe which tells the story of Robin and Diana Cavendish and is produced by their son Jonathan, now a London movie producer. At the age of 28, Robin Cavendish was diagnosed with polio and given 3 months to live. Defying all odds, Cavendish lived another 38 years, becoming a worldwide advocate for the severely disabled and introducing numerous innovations to improve the mobility of people who needed ventilators to breathe. Breathe is first and foremost a love story about the miracles that happen when love makes all things possible.

Talk to you Thursday!

Hi Catherine and Team,

I found the flip book for the pension annual wrap up somewhere, but now I can’t find it anywhere. Can you please help me locate it?

Thank You,

Colleen

Where can I find your “Let’s Go to the Movies” review of “The Crown” and the thoughts you said you were going to share on the role of the British royal family in the changing political landscape and the shift to Global 3.0 as mentioned in the Annual Wrap-Up – Part 2?

Catherine……………..I so admire the way that you are willing to share your past troubles willingly with your listeners, to give them an idea of what these demons are capable of doing. I, also, lost a lot of money and “stuff”; due to too much trust placed in people not worthy of it. When one is forced to “dial” down; you find that you have skills and resources that you never thought that you had. I believe that you stated that you are not buying into the current medical system. I would like to go more natural and holistically with treatments. Not only do I not like the drugs that they push on you; but I do not like the ever- present questioning about personal things, such as why they do not have an Advanced Care Directive from me, and questions sent to the home about my eating habits, finances, and thoughts……….. Yes, I am not kidding!………………with HMOs, they do this!

If you feel like sharing; please let me know what your thoughts are on how you came to this decision; as I am about to do the same. Thank you , again……………

https://solari.com/blog/musings-on-health-and-health-insurance/

Just read the musings, Catherine……………………thank you………………….it will help me make up my mind, but my sentiments exactly, at this point…………you have expressed this magnificently……….we are being railroaded into something that we do not need……………Blessings, Lauran

Thank you for the heartfelt Wrapup.

“It’s not a crisis, it’s a plan.” (!) $50+ trillion gone/”given” away with no contractual basis. When explaining in rational terms “assistance” given to too-big-to-fails in 2008 or DOD “unsupported adjustments”, I get the polite “it’s beyond me”, or their pupils dilate with the crazy person alert, or the silence, or very occasionally agreement “but nothing they can do anyway”.

“It’s a political problem.” “We have to change the narrative.” Caused remembrance of decisions are made on the emotional level, then rationalized, and you reach folks emotionally with arguments framed in terms from their worldview. Can’t remember who imparted that, George Lakoff, Michael Parenti? Anyway it is important to put in a narrative, context or frame that resonates with the listener details of missing $trillions, which I’m obviously not doing.

And was always suspicious of IRAs and tax advantaged accounts they could easily change the rules on after the fact too. Now if it was as easy to invest locally, without being an accredited investor or entrepreneur, as it is to buy the DOW. Thanks again!

And that, John, is why they make sure it is not so easy – including shutting down the Hamilton Securities software tool development on “Community IPO in a Box – spit out a prospectus for your community databank and equity pool after clicking your way through radio dots!

Our collective survival depends on changing this governance structure – otherwise very little will have integrity.

I couldn’t agree more, Catherine, with your last statement about our collective survival. The present governance state is a corporate model which will continue to profit off of our labor, our energy and our very souls if we allow it. This model is built on population attrition and in my opinion is being implemented on a global scale. We must change this structure before it is too late to change it. Mr. Bigelow put it very well. This is not a crisis; it is a plan and going very well for the corporate aristocracy. Vampires anyone?

Yup. Was talking with someone about the blood therapy that is being used in Silicon Valley. So it goes like this. Those in the know use their knowledge to rig government money to make them rich. That drains the people not in the know. Then the people who are now rich buy blood from the children of the people not in the know that need to sell their children’s blood to buy food for the family. Vampire. Exactly.

THANK YOU for your views on pension funds. It encompasses the Complete Solari Model …. I appreciate you sharing your personal situation with us. Very helpful. Almost every successful person has gone thru some kind of hell and many are unwilling to tell their downside story.

Like Reverend Ike said ‘When you’re going thru hell, KEEP ON GOING!’

Note: I hope that the newer Solari members get some Solari background. Otherwise there could be some culture shock!! ‘When your heroes become zeros, we need a new paradigm.’ (Can be a bit scary until we re-form our world view ….)

Very much appreciated … as always.

All the best!!

Thanks, Dave. Appreciate it. Very challenging to wade through all the information on pensions. $20 trillion and entire industry of hardworking, smart experts lost in the weeds. Scary.