“Know what you own, and know why you own it.” ~ Peter Lynch

By Catherine Austin Fitts

Please join me this Thursday for the 1st Quarter 2020 Wrap Up Equity Overview with the quarterly blockbuster from Rambus Chartology. Check out the web presentation on Thursday here for the quarterly financial charts and Rambus Chartology.

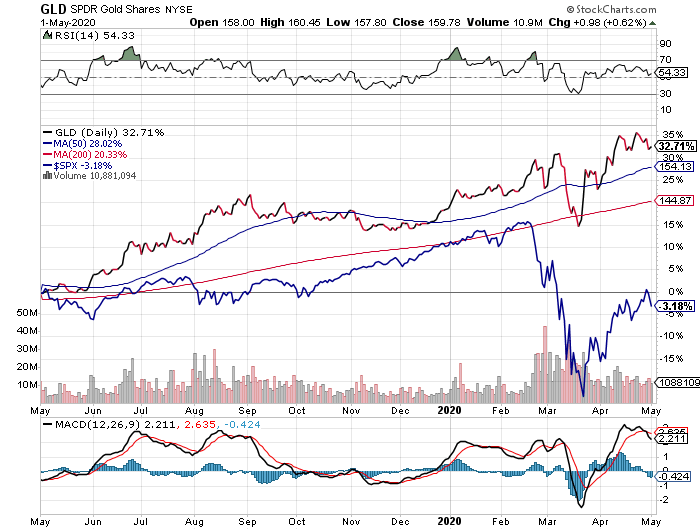

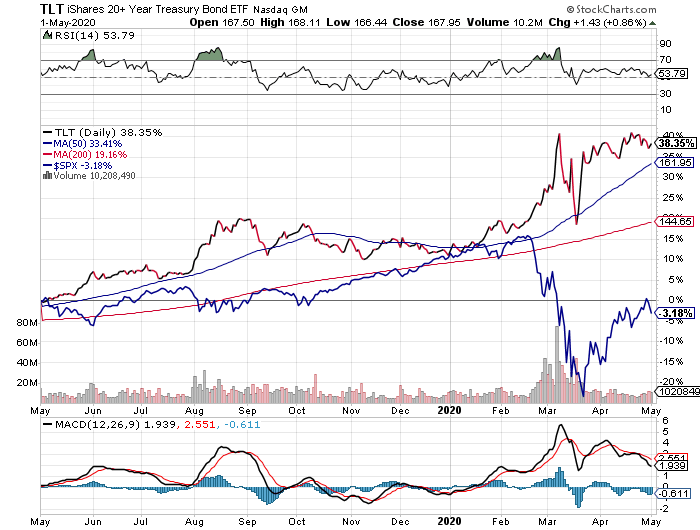

The long overdue major correction in global equity markets finally came in the 1st Quarter. Two of the best performing assets have been gold and Treasury securities. We are watching a reassertion of the long-term bull market in gold. The Rambus Chartology will focus on precious metals.

Treasury securities are more problematic. A lethal combination of bioweapons and the global “shriek-o-meter” appears to be supportive of a strong short-run performance—although given central bank and back-door buying, we can’t be sure how real it is.

While the total return of long-term Treasuries has matched or outperformed gold, the credit quality continues to debase at astonishing speeds—a fact investment managers managing billions are ignoring as they look for liquid markets. Those are the markets that the leading central banks are willing to support as they expand their balance sheets by many multiples. The question in this game of musical chairs is who will get left holding the bag when the music stops. Unfortunately, it is likely to include our pension funds.

If you have not checked out the new Stimulus Tracker in the Solari Report News Trends & Stories section, I encourage you to do so. One likely result of this much stimulus is significant inflation for years to come. Other scenarios include those in which radical reengineering can produce off-setting deflation, including with war in its various forms—piratization, cyberwarfare, biowarfare, and depopulation.

In my opinion, leaders in the tech and financial communities are financing and promoting technologies that are designed to install the equivalent of an operating system in a human—a system that can monitor and mind control and be integrated with crypto digital transaction systems. This proposed direction would mark the end of privacy and sovereignty, whether at the individual or governmental levels. Bill Gates and Microsoft (now leading the JEDI contract for DOD) intend to extend their success in getting viruses and back doors into our computers to another level—inserting viruses and back doors in our bodies and mind. The good news is that their psychopathy is oozing out of the closet, enabling more people to recognize it for what it is.

This vision anticipates a very different future than simply a drop in GNP with a V-shape recovery within existing corporate and governmental systems.

Will the current framework hold? What endures depends on you and me. Consequently, you need to ask yourself what you wish to emerge with your intention, your time, and your investments and money before you simply play “follow the leader” to Mr. Global. What is the point of achieving a return on assets if your support is financing a future in which your assets are likely to be confiscated, or a future in which you do not control your own mind, let alone your wallet? Why finance psychopaths to build your own prison?

We still each want to know, “What should I do?” “Where do I deploy my assets on the chessboard?” I will address the short-term practical issues as well.

Please join me for the 1st Quarter 2020 Equity Overview. We have a lot to talk about!

In Let’s Go to the Movies this week, I recommend you check out the recently launched Health Freedom Summit and The Truth About Vaccines 2020, both of which feature an all-star line-up of many of the best sources on health and health freedom to date: Robert Kennedy, Jr.; Mary Holland; Polly Tommey; Jon Rappoport; Dr. Suzanne Humphries, MD; Dr. Judy Mikovits; Dr. Andrew Wakefield; Del Bigtree; and many more.

https:/healthfreedomsummit.com/

Subscribers can e-mail or post questions and story suggestions for Money & Markets for this week and find current financial charts here.

Related Solari Reports:

1st Quarter Wrap Ups:

1st Quarter 2020 Wrap Up: The Real Deal on Going Local – The Infrastructure Challenge with Chuck Marohn

1st Quarter 2020 Wrap Up: News, Trends & Stories, Part II with Dr. Joseph P. Farrell

1st Quarter 2020 Wrap Up – News Trends & Stories, Part I with Dr. Joseph P. Farrell

1st Quarter 2020 Wrap Up – The Real Deal on Going Local – The Final Mile with Patrick M. Wood

1st Quarter Wrap Up: Where to Stash Your Cash in 2016

Related Reading:

What Percentage of My Assets Should I Hold in Precious Metals?

Hi Catherine, there are abbreviations on Rambus Charts that I don’t know what they represent; for example, BT, BOG, BO, PO, FBO. Could you please direct me to where I can find out what those abbreviations mean? Many thanks!

Headed out. Will take a look at post later today or by M&M

Catherine:

Great Wrap-up, especially the end where you give tips about Wealth Risk Mitigation. Can you go into more detail about finding a good lawyer, i.e. what kind of lawyer, how to find one, etc? Thanks.

Bill – will address in Ask Catherine next week.

Not sure if this has been covered still catching up on all the content, but MSFT filed a patent linking cryptocurrency mining to body activity – I think this was a black mirror episode. https://patentscope.wipo.int/search/en/detail.jsf?docId=WO2020060606&tab=PCTBIBLIO

“leaders in the tech and financial communities are financing and promoting technologies which are designed to install the equivalent of an operating system in a human”

When I read that I could only think of this: https://www.youtube.com/watch?v=ggUtlUHIqQQ

Even if resisting humans get stripped bud naked so to speak we can still do this.

Tchaikovsky-Hymn of the Cherubim – Liturgy of St John Chrysostom – I have never heard that before. I really needed that! That is certainly going into the music pile.

And look at the authors of this youtube clip: The Russian Minister of Culture’s choir. And here we are in the US fighting with the Russians…Russians being culture of people rich in faith, the arts, and classical music beauty. Much to learn from them on how to nurture and preserve beauty into the culture.